Jeffrey Kennedy – Where to Start Your Elliott Wave Count on a Chart

$99.00 $49.00

Jeffrey Kennedy – Where to Start Your Elliott Wave Count on a Chart

Sale Page

Archive Page

Get Jeffrey Kennedy – Where to Start Your Elliott Wave Count on a Chart on Salaedu.com

Description:

YOU UNDERSTAND ELLIOTT WAVES. BUT SOMETIMES…

You know EW basics. In fact, more than that, perhaps you’ve seen the power of waves in your trading — and you are ready for more.

You pull up a chart of your favorite stock: maybe it’s APPL, or TSLA, or NFLX.

Now comes the hard part: Do you start the wave count on the very first day the stock began trading?

Or do you go back to January 1? Or to the first of this month?

We get it. Great news: If you wrestle with these questions, this quick, on-demand course is for you.

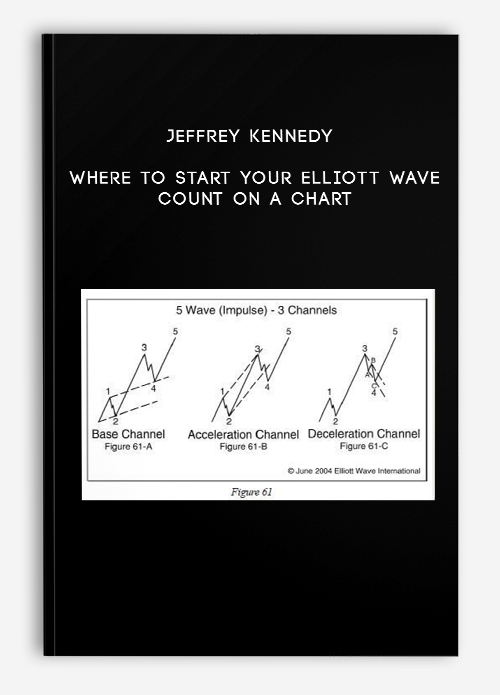

DISCOVER TECHNIQUES TO ESTABLISH A WORKING WAVE COUNT FAST

This practical 1 hour lesson comes from Jeffrey Kennedy, long-time editor of our Trader’s Classroom subscription service and the instructor of many of our most popular courses.

It shows you, simply, several hands-on ways to start a wave count properly.

Hint: It comes down to this all-important question — “Do I see a wave pattern I recognize?”

This quick, on-demand lesson shows you how to apply that query in practice, right now.

YOU LEARN BY WATCHING REAL-MARKET CHARTS

In this 1 hour, rapid-fire lesson, Jeffrey Kennedy shows you charts of five stocks:

Navistar International Corp. (NAV)

Walgreens Boots Alliance, Inc. (WBA)

Hershey Co. (HSY)

Cisco Systems, Inc. (CSCO)

JD.Com, Inc. (JD)

Real markets, real-life Elliott wave application.

Bond -Stock Trading course: Learn about Bond -Stock Trading

Bond trading definition

Bond trading is one way of making profit from fluctuations in the value of corporate or government bonds.

Many view it as an essential part of a diversified trading portfolio, alongside stocks and cash.

A bond is a financial instrument that works by allowing individuals to loan cash to institutions such as governments or companies.

The institution will pay a defined interest rate on the investment for the duration of the bond, and then give the original sum back at the end of the loan’s term.

A stock trader or equity trader or share trader is a person or company involved in trading equity securities.

Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker.

Such equity trading in large publicly traded companies may be through a stock exchange.

Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets.

Stock traders can trade on their own account, called proprietary trading, or through an agent authorized to buy and sell on the owner’s behalf.

Trading through an agent is usually through a stockbroker. Agents are paid a commission for performing the trade.

Major stock exchanges have market makers who help limit price variation (volatility) by buying and selling a particular company’s shares on their own behalf and also on behalf of other clients.

More Course: BOND – STOCK

Outstanding Course:Stockcyclesforecast – Stock Trading Using Planetary Cycles – The Gann Method Volume I,II + Gann Astro Vol III Horoscopes and Trading Methods.

1 review for Jeffrey Kennedy – Where to Start Your Elliott Wave Count on a Chart

Add a review Cancel reply

Related products

Forex - Trading & Investment

Jeffrey Kennedy – Which Elliott Wave Scenario Is the Right One

Forex - Trading & Investment

Jeffrey Kennedy – Trading the Line. How to Use Trendlines to Spot Reversals and Ride Trends

Forex - Trading & Investment

Jeffrey Kennedy – 5 Basic Elliott Wave Patterns + Technical Tools

Stock - Bond trading

Jeffrey Kennedy – 3 Steps to Spotting High-Confidence Setups in Your Charts

Forex - Trading & Investment

Stock - Bond trading

Jeffrey Kennedy – How to Actively Manage and Close a Trade Using Simple Elliott Wave Analysis

Forex - Trading & Investment

James Bittman – Investing with LEAPS. What You Should Know About Long Term Investing

king –

We encourage you to check Content Proof carefully before paying.

“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”

If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.

Thank you!