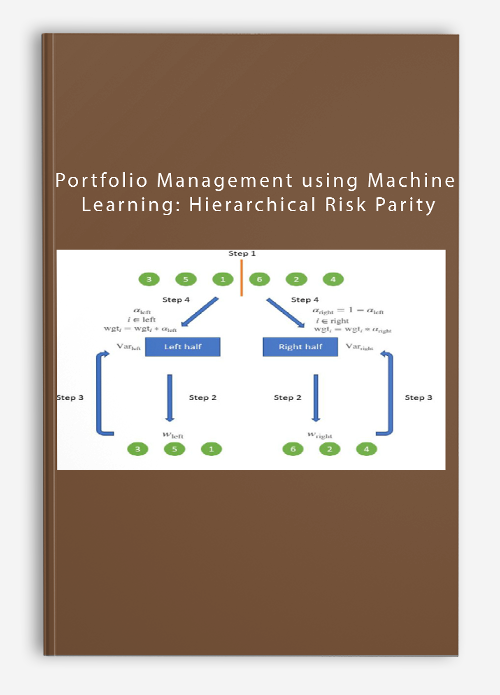

Portfolio Management using Machine Learning: Hierarchical Risk Parity

$89.00

- Calculate and graphically depict portfolio performance statistics, including returns, volatility, and drawdowns.

Portfolio Management using Machine Learning will teach you the implementation of the hierarchical risk parity (HRP) strategy on a set of sixteen stocks and the evaluation of its performance in comparison to the inverse volatility weighted portfolios (IVP), equal-weighted portfolios (EWP), and critical line algorithm (CLA) techniques. Also included are concepts such as risk management, hierarchical clustering, and dendrograms.

About Quantra/QuantInsti QuantInsti® Quantinsti stands as the world’s leading research and training institute in algorithmic and quantitative trading, with users registered in 190+ countries and territories. Founded by the creators of Rage, one of India’s premier HET firms, Quantinsti has been facilitating user growth in this field for over a decade through its ecosystem of learning and financial applications.

Portfolio Management using Machine Learning with Quantra Are you in search of a dependable method to distribute your capital among various assets within your portfolio? This particular course is worth enrolling in.

- Implement a hierarchical risk parity approach to allocate weights to a portfolio.

- Develop a stock screener.

- Explain inverse volatility weighted portfolios (IVP) and the critical line algorithm (CLA).

- Conduct backtesting for different portfolio management techniques.

- Elaborate on the limitations of IVPs, CLA, and equal-weighted portfolios.

- Calculate and graphically depict portfolio performance statistics, including returns, volatility, and drawdowns.

- Execute a hierarchical clustering algorithm, elucidating the underlying mathematical principles.

- Describe dendrograms and provide interpretations of the linkage matrix.

Other course: Risk Parity

Be the first to review “Portfolio Management using Machine Learning: Hierarchical Risk Parity” Cancel reply

Related products

Forex - Trading & Investment

Mike McMahon – Professional Trader Series DVD Set (Full) (tradingacademy.com)

Forex - Trading & Investment

Options University – Technical Analysis Classes (Video, Manuals)

Forex - Trading & Investment

Michael Parsons – Channel Surfing Video Course (Manual,Video)

Forex - Trading & Investment

Paul Lemal – Bottom Springers. Bonsai Elite WaveTrader Course (8 DVDs & Manuals)

Forex - Trading & Investment

Forex - Trading & Investment

Pristine – Oliver Velez & Greg Capra – Trading the Pristine Method. The Refresher Course – I & II

Reviews

There are no reviews yet.