Macro Ops – Price Action Masterclass

$397.00 $79.00

Macro Ops – Price Action Masterclass

Archive : Macro Ops – Price Action Masterclass

Becoming successful in trading and investing is not an easy journey.

It’s a rough road — one filled with more twists, turns, potholes, and dead-ends than you can count.

Each leg of the journey has it’s own pitfalls, whether it be learning to read financial statements, sizing your positions correctly, risk management, emotional control, or even building up your capital in the first place.

But the most treacherous portion of the rough road is also the one that seems the simplest — technical analysis.

The story usually starts the same… a brand new investor (we’ll call him Bob) gets drawn into the markets after hearing stories of all of his friends getting rich.

“Yea man, I just bought this new stock indicator that never fails! I’m telling you… this is BIG LEAGUE. I made 200% on my last trade. The way this is going, my wife is about to get that new Lexus real soon!”

Now Bob doesn’t like his wife enough to get her a new Lexus (he’s sick of her nagging), but he’s not opposed to getting one for himself. So he jumps on the web that night to figure out this whole stock trading thing.

A simple Google search brings up a few different results.

One set of links takes him to some complicated definitions on Investopedia relating to things like fundamental analysis and even something wayyy out there called macro (hehe).

Looks tough. Bob sets those options aside for the time being.

The second set of links brings him to some flashing pictures with pretty colored lines drawn all over them. And right next to all the action are clear promises of riches with “just 3 simple steps!”

Well damn, this decision is pretty clear for Bob. He’s gonna go with the action-packed, fun and easy way to supreme riches. He’s gonna go with this magic bullet called technical analysis!

You can probably predict how the story goes from here…

Bob jumps straight into the deep end using “technical analysis” to grab his share of the market pie.

But to his surprise, the first technical indicator he tries doesn’t work. Bob ends up losing money.

No problem though! It must have just been a bad indicator.

This time Bob decides to play it smarter, and instead of just using any old indicator, he buys an entire technical system. There’s a ton of these systems on the web from various experts that have clearly made millions. These systems must work.

Bob then proceeds to pony up 3 grand for his shiny new BIG LEAGUE technical system. 3 grand is nothing in the BIG scheme of things. Especially for soon-to-be-millionaire Bob.

He ends up losing money yet again.

Now after feeling more than a little bit stressed by his continual failure, Bob tries to combine his old indicator with this new system, and throw the Frankenstein creation into a pot with a new signal generator he found yesterday. Pretty soon he has a complex army of indicators being deployed at once in an effort to find the magic combination that will unlock the market safe.

The result?

More losses.

The cycle continues until Bob is thoroughly beaten and bloody. He’s lost thousands upon thousands of dollars. He’s depressed and distraught. At this point, even his wife starts looking good again… because honestly anything is better than this inhumane cruelty called technical analysis!

This is where most traders give up. At this point they’re ready to throw it all away.

“Screw technical analysis! It’s a sham pushed by snake-oil marketers that’s made to lose money. To hell with it!”

We’ve been there.

We’ve dealt with the countless losses that come with the “easy way out” strategy so many of today’s technical analysis systems and indicators claim to provide.

This is why technical analysis is often the most dangerous part of the trading and investing rough road. Everyone and their mother tries to make it seem so simple, when in reality, it’s not!

Not at first anyway…

Bob made the same mistake every new trader does. He went searching for the “Holy Grail”.

He thought he could find the one indicator or signal that would completely change the game. He was looking for a special key to unlock the market’s riches.

This search led to him to combine this indicator, with that signal, with this other special something called a “whammy” line, into nothing more than a complex pile of crap.

Of course this only meant more losses…

There’s no such thing as a Holy Grail in the markets. It doesn’t exist. Chasing it will only lead to failure through complexity. Don’t be a Bob.

As we said, this is where many would-be traders drop off. But if you stand your ground, there’s potential you can reach the other side.

And on the other side of this complexity that was constructed through failed after failed attempt at “technical analysis” is something familiar… simplicity.

Simplicity is the reason you started with technical analysis in the first place. It’s the reason price action caught your eye!

Mastering technical analysis/price action, and we mean truly mastering it, is no different than mastering any other skill. It’s must be done by finding simplicity on the other side of complexity.

Simplicity —> Complexity —> Simplicity

When you first start out learning about price action you think “Wow, this is easy! All I have to do is draw this line and buy when price crosses it!”

This is called uninformed optimism. You don’t know anything about technical analysis and that’s why it seems so simple.

This quickly leads to losses, which leads to overcompensation through the addition of more and more technical indicators, which results in a mess of complexity (Bob’s story).

It’s here that you realize that technical analysis isn’t simple. It’s a complex juggernaut. You develop something called informed pessimism.

Many traders go through these first two stages. They’re easy because they’re the result of a lack of deep understanding. Something looks simple and then it’s not. Game over.

The third stage, simplicity on the other side of complexity, is far more difficult to reach. It requires dedicated study of the subject and true mastery.

As Supreme Court Justice Oliver Wendell Holmes once said:

“I would not give a fig for the simplicity this side of complexity, but I would give my life for the simplicity on the other side of complexity.”

Picasso’s The Bull shows this process perfectly.

A master of abstraction, Picasso’s bulls show how he took complex pictures and stripped them down to their most simple, abstract parts.

In Pablo Picasso’s own words:

“To arrive at abstraction, it is always necessary to begin with concrete reality … You must always start with something. Afterward you can remove all traces of reality. There’s no danger then, anyway, because the idea of the object will have left an indelible mark.”

Apple Inc. uses Picasso’s illustration to show their design team what to strive for.

Simplicity, simplicity, simplicity!

As Steve Jobs said:

“That’s been one of my mantras — focus and simplicity. Simple can be harder than complex. You have to work hard to get your thinking clean to make it simple. But it’s worth it in the end because once you get there, you can move mountains.”

There’s a reason Apple products reign supreme. They take fantastically complex machines like smartphones and make them extremely simple for their customers to use. Their relentless focus on reaching that simplicity on the other side of complexity blows their competition out of the water.

And just in case you needed more convincing of this concept, here’s Bruce Lee to hit it home:

“It is not daily increase but daily decrease. The height of cultivation always runs to simplicity. Before I studied the art, a punch to me was just like a punch, a kick just like a kick. After I learned the art, a punch was no longer a punch, a kick no longer a kick. Now that I’ve understood the art, a punch is just like a punch, a kick just like a kick. The height of cultivation is really nothing special. It is merely simplicity; the ability to express the utmost with the minimum. It is the halfway cultivation that leads to ornamentation.”

It’s no different with price action. To be successful, you need to break through complexity and reach simplicity on the other side.

We’d like to help you through that complexity fold.

Our team at Macro Ops has gathered all our insights from years of fighting complexity on the market’s rough road to create the:

Price Action Masterclass: The Theory & Tactics Legendary Traders Use To Wring Billions Out Of Markets

Get Macro Ops – Price Action Masterclass on Tradersoffer.com

This isn’t your average technical analysis course.

We’re not just going to show you how to draw lines on a chart.

We’re not just going to show you how to read a few random indicators.

We’re going to help you achieve much more.

In the Price Action Masterclass, we take a deep dive into the theory and philosophy behind price action. Our goal is to help you build the solid foundation and understanding needed to reach a mastery level in technical analysis.

True mastery is the only way to reach simplicity on the other side of complexity.

The goal here isn’t to teach you some basic technical strategy that only works in the current market environment and falls apart with any small change.

We want to teach you why technical analysis can be effective in analyzing markets and how you can use that information to profit.

“Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.”

Now this isn’t to say we won’t provide you with any price action tactics. This course is not all theory. It’s absolutely actionable. We’re going to show you exactly how we conduct our technical analysis at Macro Ops. We’re talking step-by-step instruction.

But before we do that we’ll equip you with the knowledge you need to take full advantage of those tactics and techniques. At the end of this course, you’ll even be able to create your own technical methodology.

The course structure is as follows:

Philosophy —> Theory —> Quant —> Tactics

The philosophy, theory, and quant sections are essential for true mastery of the eventual tactics.

Below you’ll find a sample lecture from the philosophy section of the course called:

Sturgeon’s Law: 90% Of Everything Is Crap!

This is just one example of the FULL technical analysis education we’ll be providing you with.

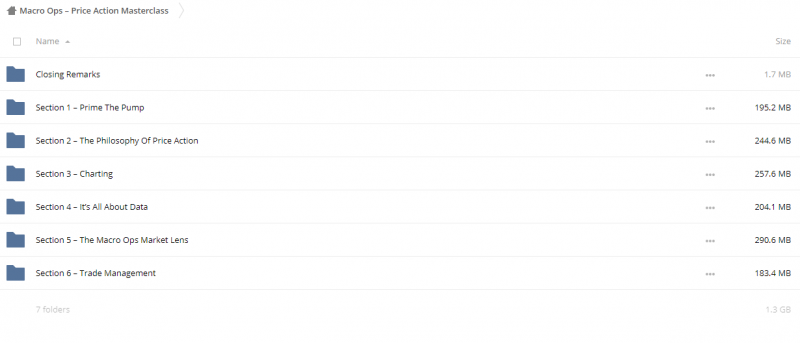

The course consists of 6 separate sections with 26 lectures in total. This is equivalent to over 6.5 hours of video content. Like we said, this is a full education we’re providing here.

Below you’ll find the entire table of contents of exactly what you’ll learn in our masterclass:

Section 1 – Prime The Pump: Prep Your Mind For Success

Lecture 1 – A Beginner’s Mind… — Extracting maximum value from any class or course requires rewiring your mind to emulate a beginner. This lecture helps prepare you to reach that mindset and unlock your full learning potential.

Lecture 2 – The “Value” In Price Action — Discover the value price action brings to a trading process. It’s far more than just basic identification of trade setups. Price action helps with risk control, emotional management, timing, and more.

Lecture 3 – Multidimensional Forecasting — Say goodbye to vague “CNBC” style forecasting and learn all the components involved in a real, executable, and definable trading signal.

Section 2 – The Philosophy Of Price Action: A Foundation For What’s To Come

Lecture 4 – Simple Is Beautiful — Keeping you price action technique simple is the key having it survive over the long haul. But that’s not all. A simple price action system allows us to quickly find excellent trade candidates as well as easily measure performance. This lecture makes the case against “indicator soup” and other complex technical methods.

Lecture 5 – Deathmatch: Techs Vs Fundies — A deep dive into the heated debate between technicians and fundamentalists. At a high enough level, both camps are actually executing a similar process. But at the end of the day everyone is a slave to the tape.

Lecture 6 – Sorry Miss Cleo… It’s About Possibilities, NOT Predictions — Successful Operators know that price systems will never be 100% accurate. Trading is a probabilistic endeavor. Expecting certainty sets you up for failure. This lecture helps move expectations from certainty to managed uncertainty. Poker is used as analogy.

Lecture 7 – Sturgeon’s Law: 90% Of Everything Is Crap! — One of the most difficult parts of active trading is avoiding “middle of the road” setups. Aligning yourself with Sturgeon’s Law will help you trade within pockets of clarity and avoid mediocrity.

Lecture 8 – Isn’t It All Just Random Anyway? — Most technical practitioners will never touch the subject of market randomness. This lecture does the opposite. We attack the conundrum head on and offer ways to mentally deal with the reality of a quasi-random market.

Section 3 – Charting: Transforming Pretty Pictures Into Strategic Strike Maps

Lecture 9 – Reading Price Is Reading Emotions — Understanding that charts are a detailed map of investors’ emotions helps clarify why price action systems work. This understanding is key to building confidence when using any technical method.

Lecture 10 – The Two Faces Of Price: Consolidation and Trend — This lecture lays the groundwork for a complete mental model of price action. At the highest level price can only do two things: trend or consolidate. Knowing this helps a trader digest complex market fluctuations.

Lecture 11 – The Breakdown: Deconstructing Trends — Since the beginning of markets, master speculators have exploited trending behavior to generate billions in profits. This lecture dives deep into the theory and structure behind lucrative trends in financial markets.

Lecture 12 – Life In Pieces: Fractals — The discovery of fractal geometry by Benoit Mandelbrot began when he looked at price action in the markets. Understanding fractals will help you reconcile price movements on multiple timeframes.

Section 4 – It’s All About Data: Use Numbers & Score Big

Lecture 13 – The Random Walk — Find out how quants model the market and where that model breaks down. The binomial model is also proposed as a more intuitive way to understand the random walk. Embracing randomness rather than fearing it is a healthy approach for any trader battling the markets.

Lecture 14 – Noise Vs Signal: Can You Hear Me Now? — Some markets are harder to trade than others. This reality is explained and quantified using the efficiency ratio.

Lecture 15 – Back And Forth: Momentum and Mean Reversion — Learn how quants categorize price movements across multiple timeframes. Two main forces emerge, momentum and mean reversion. You can exploit these forces by correctly identifying where and when each is likely to dominate.

Lecture 16 – V Is For Volatility — Studying price action without understanding volatility is like driving blindfolded. Volatility conditions can overwhelmingly determine the success or failure of a technical signal. In many ways the volatility of price is more predictable than price direction itself. You will learn how to apply knowledge of volatility to a price action system.

Section 5 – The Macro Ops Market Lens: Consistently Execute Profitable Trading Ideas

Lecture 17 – Target, Deploy, Profit — There are many ways to skin the cat when it comes to analyzing price. Macro Ops uses classical charting patterns as a market lens. Learn the pros and cons of this method.

Lecture 18 – The Nitty-Gritty Of Price Patterns — This lecture goes through all the classical chart pattern setups we use to execute trades. The key is to avoid “Rorschach analysis” and only focus on what’s crisp and clear.

Lecture 19 – *Knock Knock*: Entries — What’s the difference between an “okay” entry and a perfect one? Find out as we dissect what a quality breakout bar looks like. This lecture also touches on breakout failures and retrace entries.

Lecture 20 – It’s Morphin’ Time! …For Patterns — Chart patterns can morph and fizzle into unintelligible chicken scratch. Understanding the reason for pattern failure will help set expectations. It will also steer us away from market conditions that make price pattern trading more likely to fail.

Lecture 21 – Timeframes — A full out discussion on which timeframes to focus on and why. Higher timeframes offer the best combination of stability and efficiency. Also discover how to use multi-timeframe analysis to uncover extremely fruitful “nested” patterns.

Lecture 22 – A Game Of Nuance — Each asset class behaves in its own unique way due to differences between the market players trading them. Fixed income will never trade like oil. And a hot tech stock will never trade like an equity index. Awareness of these market nuances will help you tweak your price action analysis to better fit a target market.

Lecture 23 – Scoping Your Targets — Get a front row seat to how we scan through markets searching for that next big win.

Section 6 – Trade Management: Increase Your Profitability And Protect Your Emotions

Lecture 24 – Graceful Exits — Entering a trade is only the beginning. To maximize your edge in the market you must become a master at exiting trades. This lecture explores all different types of exit strategies for losing trades and winning ones.

Lecture 25 – Probability Mutation — The location of your stops and targets have a much higher influence on your win rate than anything else. Quantifying and understanding the theoretical breakeven rate on a trade setup will give you a ballpark estimate of a trade’s probability of success. Armed with this knowledge you can tweak your system to fit your emotional needs.

Lecture 26 – Bayesian Inference — Master traders, the best in the business, are able to effectively make adjustments and tweaks to existing trades as new information becomes available. This process is called Bayesian Inference. Learn how to apply this advanced technique to your trading.

Section Recaps & Action Steps

Each section concludes with a recap of everything covered, including action steps to help students put both theory and methods into practice. This will ensure that you internalize the most important parts of each lecture to utilize them in your trading process going forward.

The knowledge in the Price Action Masterclass will not only help you succeed in the markets today, but tomorrow as well.

We all know about the growing prevalence of high-frequency traders. Profiting in the market has become more difficult because of these machines’ ability capture market inefficiencies in just nanoseconds.

The technical legends of old had to transform their individual strategies to account for the new normal we’re now faced with. The reason they were able to successfully adapt is because of their deep understanding of price action. Robots or no robots, it didn’t matter. Their knowledge transcended any “flavor of the day” market changes.

Those using more surface-level technical analysis, even with their success in the old markets, were eventually wiped out as technology progressed. Their strategies stopped working. And because they didn’t truly understand price action, they couldn’t adapt.

Today we are facing yet another massive change coming to the markets. We call it the the quant wave.

Everyday there’s another fund dropping their old strategies and moving to “quant”. Now quant can mean a lot of different things, but in general it consists of using more and more data fueled predictions to profit from markets. Technology is being leveraged to the max. And this isn’t even mentioning the advances in AI that are coming to the market daily.

Does this mean technical analysis won’t be effective going forward?

Absolutely not.

It means that markets will change, just like they always have. But at the same time, they’ll remain the same.

It’s difficult to understand the piercing truth of this statement if you don’t understand how price action truly works. If you don’t develop a real mastery, then you will not survive the coming changes.

But we’re here to prepare you.

Here’s the deal. You get this entire 6.5 hour Price Action Masterclass, including unlimited access to the Macro Ops team for any questions you may have, all for just $397.95.

Enrollment also comes with a 60-day money-back guarantee. You can take the entire course and if you believe you didn’t learn anything, we’ll return your money right away. We are THAT confident in the material we’ve created.

Once you purchase the course, you will be sent a username and password to access the videos on our website. All sections and lectures are released at once, so you may watch at your own pace. Feel free to skip around from video to video or watch straight through from the beginning. Each lecture also has a comments section where you can ask questions and go back and forth with the Macro Ops team regarding the curriculum.

There is absolutely zero risk to take a shot at the unlimited upside provided by this course.

Get Macro Ops – Price Action Masterclass on Tradersoffer.com

Macro Ops – Price Action Masterclass Download, Price Action Masterclass Download, Price Action Masterclass Groupbuy, Price Action Masterclass Free, Price Action Masterclass Torrent, Price Action Masterclass Course Download, Macro Ops – Price Action Masterclass Review, Price Action Masterclass Review

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Macro Fundamentals Trading Course from Fotis Trading Academy

Related products

Forex - Trading & Investment

Forex - Trading & Investment

Forex - Trading & Investment

Pristine – Oliver Velez – Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

Forex - Trading & Investment

Pristine – Oliver Velez & Greg Capra – Trading the Pristine Method. The Refresher Course – I & II

Forex - Trading & Investment