TRADINGMARKETS – Programming in Python For Traders

$1,995.00 $227.00

TRADINGMARKETS – Programming in Python For Traders

Archive : TRADINGMARKETS – Programming in Python For Traders

- Do you already program in Python?

- Do you program in TradeStation?

- Do you program in Amibroker?

- Would like to learn to program?

Python has become the hottest programming language on Wall Street and is now being used by the biggest and best quantitative trading firms in the world. We’re going to teach you the benefits of Python and how it can make you a more successful trader and allow you to build better trading strategies.

Why Python Is The Language of Choice By Many Of The Biggest and Best Trading Firms In the World

The best trading firms in the world have the resources and capabilities to program in any language.

They also have the ability to hire the best and smartest traders in the world. When you look at who they’re hiring, there’s one major theme; they’re hiring traders with Python Programming skills.

You only have to look at the professional job boards to see this.

Many of the top firms are now all requiring their traders and researchers to program in Python.

The reason they’re doing this is they obviously believe Python is leading to greater trading profits.

“The Best Coding Languages to Learn for Traders in Banks, Hedge Funds and HFT Firms” by Rob Carver – former head of fixed income at multi-billion dollar quantitative hedge fund AHL, and the author of the two books, Systematic Trading and Smart Portfolios.

“Python is the preferred language of many quantitative traders because of the extensive availability of packages for data analysis”

We can show you dozens of these examples, and now tens of thousands of professionals at the top trading firms around the world do their programming in Python (not in retail products like TradeStation, Amibroker, etc.).

If you’re serious about your trading, and want to join the elite trading professionals around the world, (and not a bunch of retail traders) then learning Python is a must.

If not, you’re falling behind!

Briefly Our Story

Chris and I are a generation apart yet our journey is the same.

Amibroker and Excel have been good to me and my clients for years. TradeStation was good to Chris for years. But we both realized in order to keep up with the professional quant firms, we needed to move to an open source professionally used language.

That language, as so many major quant firms have found, is Python.

Here is Why Many of The Top Quant Firms Use Python and Why You Should Too

There are many reasons why Python has become the go-to programming language for these multi-billion dollar fund companies. This includes…

1. It’s easy to learn – You can learn how to program Python in under 10 hours. In 10 hours, you will be able to do in-depth research, code more complicated trading strategies, and analyze your backtested results better and faster than ever before!

2. It’s faster than most languages. You will spend less time writing your code which leads you to having more time analyzing your results and improving your strategies.

3. It’s Open Source – This means you’ll have access to the same trading code and tools created by many of the best researchers, programmers and traders in the world.

There’s also a global community available 24/7 to answer any questions you may have. Python is widely used and well documented, making solving coding issues a breeze. If you’re stuck on a coding problem, many people out there will be able to help you.

In fact, even a quick Google search usually answers your questions!

4. Python has the best libraries for data analyses and quantitative trading. This means again you will be using the same tools as professional quant trading desks and hedge fund managers do. This can’t be said for other languages like TradeStation and Amibroker.

Get TRADINGMARKETS – Programming in Python For Traders on Tradersoffer.com

This means you’ll find edges in the market faster and more efficiently than ever before.

How To Program With The Same Tools As The Best Quantitative Trading Firms

If you’re interested in joining the ranks of the best quantitative trading firms in the world including multi-billion dollar trading firms like Tudor Investments, Point 72, Millennium, Citadel, and hundreds of other professional trading firms, we are offering a proprietary 10 hour “Programming in Python For Traders”course beginning on Tuesday, September 10.

“Programming in Python For Traders”

Here is What You Will Receive

Class Outline

Week One – You’ll gain the foundation in order to do your backtesting, research and signal generation.

This foundation will lay the groundwork for you to scale into the upcoming weeks.

Your homework will include learning how to do technical analysis calculations in Python including moving averages, RSI, and the other major technical indicators used by professionals.

Week Two – You’re going to be backtesting in Python!

You’ll be writing code in Python and testing strategies and signals to find market edges. For example, you’ll be writing code using a 2, 3, or 4 period RSI on various levels, such as RSI below 30, RSI below 20, etc.

By the end of week 2, you’ll be able to test various market conditions (for example overbought and oversold conditions) and calculate the historical edges that exist in those conditions.

Week Three – You’ll be writing full fledged trading strategies. This includes allocating capital to trades, adding risk management tools, and analyzing portfolio returns.

At the end of Week 3, you will be able to run more advanced backtests of your trading ideas and strategies.

Week Four – In Week 4 you’ll be analyzing your backtests. This includes analyzing your cumulative returns, analyzing your risk (drawdowns, volatility, etc.), analyzing correlations through time, and a deep dive into analyzing individual signals in order for you to see when and how to best optimize your trading strategies.

Week Five – In Week 5 you’ll be writing more advanced backtests. This includes creating signal list generation and managing a portfolio of multiple securities. You’ll also learn advanced concepts on position sizing in order for you to optimize the edges you are finding in your strategies.

By the end of this course you will have the ability to find your own market edges, build your backtest, and do a deep analysis of the test results.

Here is What You Will Receive:

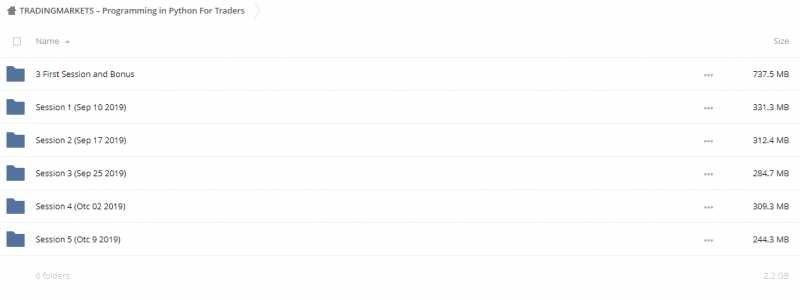

1. The Programming in Python For Traders course will run 5 weeks. We’ll meet online every Tuesday from 4:30 pm to 6:30 pm ET.

2. If you cannot attend a class live, it will be recorded for you to watch as many times as you like.

3. After each session, you will be given a homework assignment to complete. These assignments will guarantee you are successfully programming trading strategies in Python.

As each week passes, your Python programming skills will improve. By the end of Week 3 you will be writing full-fledged trading strategies in Python. By Week 5 you will be programming and analyzing Advanced Strategies In Python.

4. You will have free access to a large professional database offered by Quantopian.

Quantopian is one of the largest resources in the world for quantitative trading strategy development and their database is available for you to pull their data and build your trading strategies.

We will be programming in Quantopian together throughout the class which means you’ll be programming along with Chris gaining hands-on experience. In our opinion, this is a better and smarter way for you to learn how to program.

5. As each week progresses, you will receive all of Chris’ code written for the class.

As an added bonus throughout the course, Chris will be supplying you with pre-written trading strategy scripts that you can apply immediately and customize to your liking.

6. There will be a private Facebook Group for the class to interact with. Chris will be in the Group daily to answer any and all of your Python programming questions providing you with ongoing instruction each day in order to assure your growth and success.

7. We will be coding real trading strategies together in the class as examples.

8. After graduating you will receive a “Certificate of Completion” in Programming in Python For Traders.

9. This is the only Python for Traders course available in the world that has a combination of:

Here Are 7 Reason To Take Programming In Python For Traders:

1. The number one reason why the major quant trading firms require their traders to know Python is because it makes them smarter and better traders. It will do the same for you.

2. Python is more professional. As you know the best trading firms don’t program in Amibroker and TradeStation. By learning to program in Python, you’ll be joining the elite trading firms.

The objective of this course is in 5 weeks to move you out of the closed source retail world and you move into the open source professional trading world.

3. It’s Open Source which means you’ll have the opportunity to interact with many of the best trading programmers and researchers from around the world.

4. Python for Trading is growing and is on the cutting edge of quant finance. You’ll join the largest quant finance community in the world and this community continues to grow even stronger at a very rapid pace.

As new tools are developed, you’ll have immediate access to these new tools to further improve your trading.

5. You’ll gain access to one of the largest databases available for traders for free.

Quantopian’s data is clean data used by professionals and this includes technical analysis data, fundamental data, sentiment data, social media data, economic data, and continuous futures data.

By the end of this course you will know how take this data and build trading strategies around it.

6. You’ll have live interaction with Chris Cain.

Chris has over a decade of professional trading desk experience managing a trading book of over $400 million dollars. Chris now manages his own money full time having built his strategies in Python.

This is your opportunity to learn directly from one of the authorities in programming successful trading strategies in Python.

Our Guarantee

7. If you’re not successfully programming strategies in Python by the end of Week 3, we will provide you with a 100% money back guarantee.

That’s how sure we are that you’ll be joining the ranks of the many of tens of thousands of professional quant traders who program their strategies in Python!

Register Today For the TradingMarkets Programming in Python For Traders

The price for the Programming in Python For Traders is $1,995. This includes 5-live sessions, all class materials, and the recordings for each of the classes for you to watch and learn from as many times as you like.

Get TRADINGMARKETS – Programming in Python For Traders on Tradersoffer.com

TRADINGMARKETS – Programming in Python For Traders Download, Programming in Python For Traders Download, Programming in Python For Traders Groupbuy, Programming in Python For Traders Free, Programming in Python For Traders Torrent, Programming in Python For Traders Course Download, TRADINGMARKETS – Programming in Python For Traders Review, Programming in Python For Traders Review

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Basecamptrading – Earnings Power Play

Be the first to review “TRADINGMARKETS – Programming in Python For Traders” Cancel reply

Related products

Forex - Trading & Investment

Forex - Trading & Investment

Justine Williams-Lara – Counting Elliott Waves. The Profitunity Way DVD (with Russian subtitles)

Forex - Trading & Investment

Michael Parsons – Channel Surfing Video Course (Manual,Video)

Forex - Trading & Investment

Reviews

There are no reviews yet.