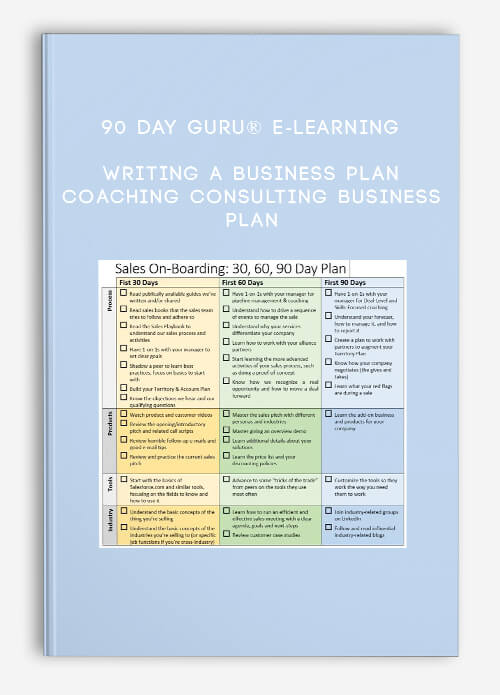

90 Day Guru® E-Learning – Writing a Business Plan Coaching Consulting Business Plan

$97.00 $32.00

Product Include:

File size:

90 Day Guru® E-Learning – Writing a Business Plan Coaching Consulting Business Plan

**More information:

Get 90 Day Guru® E-Learning – Writing a Business Plan Coaching Consulting Business Plan at Salaedu.com

Description

Simple business plan course for Life Coaches and Consultants; Learn how to write a business plan the bank will approve.

Brand New Course: Writing a Business Plan: Coaching and Consulting Business Plan was created by 90 Day Guru E-Learning for you.

You are currently a Life coach or Consultant and see the potential of writing a business plan but you want the best step-by-step guidance for how to make a business plan.

You want business plan samples, strategies and examples on making a business plan that you’ll follow and have already been tested and proven to work.

You would like logical ways to create a business plan that will inspire your life coaching or consulting business to success.

You would like to know how you can write a simple business plan in the shortest amount of time possible that can be accepted for a bank loan.

You are ready to write a business plan but just need to know the foundation pieces so you feel more confident that you are doing it right.

You are committed to following through with what you’re about to learn about writing a business plan for you life coaching or consulting business.

This is why you are here because you want to know how to write a business plan that you can follow and the bank will love. Now keep this in mind. Every piece of advice, strategy and logical approach to writing a business plan for a life coaching or consulting business has been tested; none of this is theory. You might be asking yourself; okay so what qualifies Louise to talk about writing a business plan. Great question!

Business online course

Information about business:

Business is the activity of making one’s living or making money by producing or buying and selling products (such as goods and services).

[need quotation to verify] Simply put, it is “any activity or enterprise entered into for profit.

It does not mean it is a company, a corporation, partnership, or have any such formal organization, but it can range from a street peddler to General Motors.”

Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business.

If the business acquires debts, the creditors can go after the owner’s personal possessions.

A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business.

1 review for 90 Day Guru® E-Learning – Writing a Business Plan Coaching Consulting Business Plan

Add a review Cancel reply

Related products

Business & Marketing

Jerry Banfield with EDUfyre – The Complete YouTube Course: Go from Beginner to Advanced

Business & Marketing

Jerry Banfield with EDUfyre – Master Entrepreneurship Online

Business & Marketing

Business & Marketing

Business & Marketing

king –

We encourage you to check Content Proof carefully before paying.“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.Thank you!