Chet Holmes – The Institute Course

$69.00

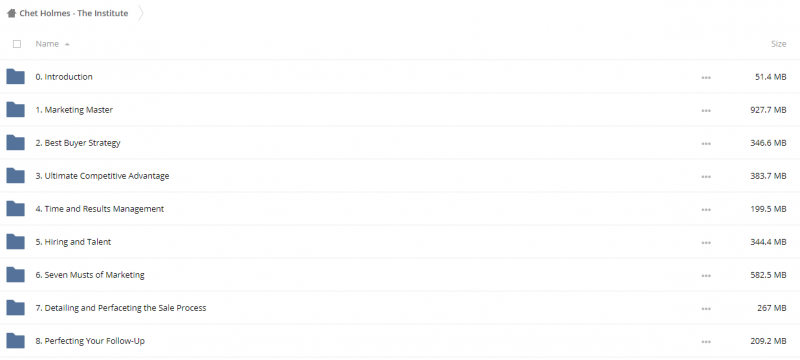

Product Include:

File size:

Chet Holmes – The Institute Course

**More information:

Get Chet Holmes – The Institute Course at Salaedu.com

Description

Want a comprehensive system to grow every part of your business?

“There are skills that many business owners and executives haven’t developed, strategies they can’t imagine, and tools they’ve never built that have the potential to radically improve the whole course of their businesses and their lives.”

Are there better methods for growing your business than you’re currently aware of?

If you ask the average CEO, “Where did you get your CEO-skills training?”

Do you know what you find?

Mostly, you find there wasn’t any training. They learned on the job – by making all the mistakes. It was training by error.

Obviously that’s not the smart way to go. It’s obvious. Right? Except most business owners are still out there using a combination of outdated tools mixed with trial and error in a heroic effort to reinvent the wheel.

If you’re going to put a big chunk of your time, money, and energy on the line in business, you must leverage the experience of recognized business experts who’ve already done the testing, research, trial and error – and most importantly, who’ve gotten the results.

The Chet Holmes Institute contains a 30-year learning curve from internationally recognized business-growth master, Chet Holmes.

Business online course

Information about business:

Business is the activity of making one’s living or making money by producing or buying and selling products (such as goods and services).

[need quotation to verify] Simply put, it is “any activity or enterprise entered into for profit.

It does not mean it is a company, a corporation, partnership, or have any such formal organization, but it can range from a street peddler to General Motors.”

Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business.

If the business acquires debts, the creditors can go after the owner’s personal possessions.

A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business.

1 review for Chet Holmes – The Institute Course

Add a review Cancel reply

Related products

Internet Marketing Courses

Fireside Chats Bundle – Ignite Your Business from Chet Holmes

Business & Marketing

Business & Marketing

Business & Marketing

Jerry Banfield with EDUfyre – Facebook Advertising March 2016

Business & Marketing

Jerry Banfield with EDUfyre – Master Entrepreneurship Online

king –

We encourage you to check Content Proof carefully before paying.“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.Thank you!