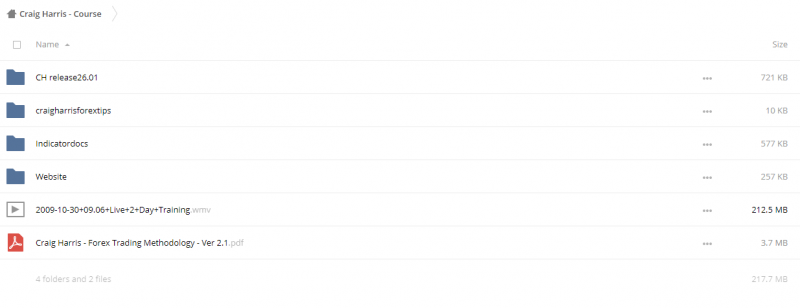

Craig Harris – Course (Video, PDF, MT4 Indicators)

$997.00 $25.00

Craig Harris – Course (Video, PDF, MT4 Indicators)

Craig Harris – Course (Video, PDF, MT4 Indicators)

Craig Harris Forex Education and Indicators

8 Years Ago when I was starting out I wish I would have had someone to guide me through the real basics of trading the Forex. For instance it took

me a while to understand that brokerages offer all kinds of free training signals and alerts because they want you to trade through their firms. But what they don’t tell you is that they take the other side of every trade (THEY TRADE AGAINST YOU).

In other words if you win they loose, so it’s in their best interest for you to loose so they can win. That means you will experience re-quotes, dealing station delays and even no response to your trade entries. All of which eventually loose you money.

Fortunately there are some options for the trader. Many Brokerages and Banks have stopped this practice and are honest with your entries and exits. You need to shop around and find those Brokerages and Banks.

Another way to ensure good fills is to use what is known as an Introducing Broker (IB’s). These are independent businesses that represent several traders at the same time. By doing this they provide clout with the Brokers and Banks, because while the brokerage or bank might disregard you as an individual they won’t disregard hundreds of traders (there is safety in numbers). Generally these IB’s have found the best Brokerages and Banks to deal with and that saves you a lot of headache trying to find; then test them out for yourself. You are represented and it does not cost you anything because the Brokerages and Banks like to deal in bigger numbers and not in onesy twosey’s. The Brokerages and Banks pay the IB’s to bring business to them so you don’t have to.

There are other strategies that you need to know if you are going to trade through a Brokerage, I cover this in more detail at my blog. Check out my blog! Also feel free to ask me any Forex trading questions you may have, with my 8 years of experience I can shorten your learning curve dramatically, so that you can be a more profitable trader.

O.K. NEXT…

In order for you to start practicing what I am showing you on the charts it will be best if you have the MT4 platform downloaded. After you have installed the MT4 platform you must now install the indicators. The indicators I use for the swH/L trade are: Slow Stochastic’s (SS) with a setting of 8 3 3 , Fractals and Support/Resistance . I am attaching the SS and Support/Resistance indicators and feel free to put them on your charts. The Fractals are already a part of the charting indicator package.

Once you have installed your indicators you can now open your Charts and from the Navigator go to Custom Indicators and add them. The swH/L Video, the Oscillator Video and the Big Number (BN) Video will give you a nice tradeable strategy that I call the swH/L Trade and I use it everyday. The Oscillator Video is simple and will make sense even to the brand new beginner. It is the next part of the THREE factors that need to be considered each time you look to enter a trade. So make sure to watch the swH/L Video again, and watch this Oscillator Video a couple of times to make sure you understand. Start watching the Natural Up and Down Flow of the Market in relation to Swings and looking for agreement with the SS.

Also once I got this trade down, I really started to be consistent in my profitability, and that is when our Lifestyle really changed. I knew how to earn money while I was on vacation … My wife and I started to stay gone longer, instead of having to come back home after a weekend trip or even a few days because I had to go to work… I could stay 10-14 days have fun and not worry about the bills. Because of the leverage of the Forex I just did not need to make a killing every day. I just needed to be consistent with 40+ pips per day.

The Big Numbers Video will help tie together the Swings and Oscillator for the Swing High/Swing Low trade. I want to insert a disclaimer here: Please keep in mind that what I am giving to you are TOOLS to use with your trade selections. There are multiple parts to trading. We use tools like Indicators, Fibs, Oscillators, Tokyo Channel, News, Money Management Formulas, even entry points like BN’s and stop losses to execute a trade. They have rules, but are not really trading strategies.

That is the other part of trading, knowing what to do once you’re in a trade and it goes against you and stops you out, and having the know how to take the information you just bought with your loss and being able to go get your money back. Not being afraid to take the loss. Knowing what to do when the market is choppy. Knowing how to determine trend of not only the day but of the session. Understanding not just the Natural Flow but also the psychology of

fear and greed that drives everyone including yourself. Knowing the market so well that you can Counter Trend Trade within the Natural Flow of the market. Knowing that you can just get into the market in any direction at any time and be able to get out within a trade or two with overall Profit.

For every tool I am going to give you there is a counter part having to do with Natural Flow, Multiple Strategy’s, Experience, Sessions you are trading, Time of Day, Ranges, Price Action, and even your Confidence. What I am talking about is your Blueprint for Trading. This is where and why the overwhelming majority of traders DON’T get it. This is not something you can get overnight or even in weeks or months……it takes years of trading to understand this. So if this does not make sense to you…….it means you have not been trading long enough….don’t feel bad as most are in the exact same spot. The hardest part of this to understand for most is: You don’t know what you don’t know!

If you really want to change your career, if you really want to change your lifestyle, if you really want to earn a High 6 figure income and not take years to do it, then there is only one way to shorten that learning curve. How does anyone really learn to be good at what they do?

…Experience …

No amount of books, courses, seminars, signal services can substitute for someone taking you through the process of giving you their experience over and over and over. Trading is not something you can get on your own without putting in YEARS of Face Time. Remember you don’t know what you don’t know. So you are going to have to make the choice……be taught by someone who knows how to trade, or be willing to trade 20 hours a week minimum for several Years, … or QUIT… everything else is a waste of time and money…. A Waste of Your Time and Your Money! By the way, we will be done with the survey soon and you will be surprised at how many are just like you.

Please watch all 4 videos several times. This swH/L Trade is an Entry Technique that I use every day. It is a tool that makes Trade Entries Mechanical. It is not a Trade Strategy. Trade Strategies include other factors like:

Trend Identification, Session Identification, Trade Time

Identification, Tokyo Channel Identification, Risk/Money Management

Identification, and News Identification.

Having said that, with practice in trading with the Natural Up and Down Flow of the market you should be able to get 40 pips a day of profit. My advice would be to quit once you get your 40 pips for without all the other Parts of Trading in Play…..you will over trade without proper knowledge and you will lose. Once you have learned and can apply the Strategical Parts of Trading (the mental side), then you will have a Blueprint for Trading and can really grow your account exponentially.

Get Craig Harris – Course (Video, PDF, MT4 Indicators) on Tradersoffer.com

Craig Harris – Course (Video, PDF, MT4 Indicators) Download, Course (Video, PDF, MT4 Indicators) Download, Course (Video, PDF, MT4 Indicators) Groupbuy, Course (Video, PDF, MT4 Indicators) Free, Course (Video, PDF, MT4 Indicators) Torrent, Course (Video, PDF, MT4 Indicators) Course Download, Craig Harris – Course (Video, PDF, MT4 Indicators) Review, Course (Video, PDF, MT4 Indicators) Review

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course: Online Trading Academy Professional Trader Series (7 Day Complete)

Be the first to review “Craig Harris – Course (Video, PDF, MT4 Indicators)” Cancel reply

Related products

Forex - Trading & Investment

Forex - Trading & Investment

Forex - Trading & Investment

Forex - Trading & Investment

Reviews

There are no reviews yet.