Daily Price Action by Justin Bennett

$35.00

Daily Price Action by Justin Bennett

**More information:

Status:

Sale Page

Get Daily Price Action by Justin Bennett at Salaedu.com

Learn to Trade Forex Like a Fund Manager

There is a reason why the likes of George Soros, Stanley Druckenmiller, and Bill Lipschutz don’t concern themselves with the 5 or 15-minute charts – it’s because they know that the real money is on the daily time frame and higher, which is the exact approach I teach in my course.

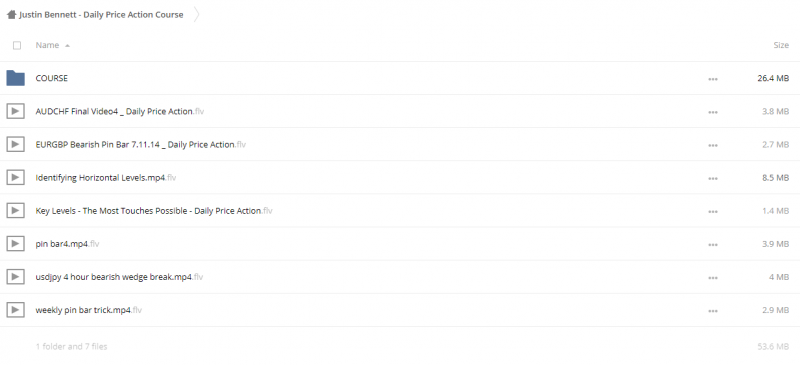

The course consists of 9 modules with each module discussing a specific segment about price action. Justin explained each concept with the help of graphical illustrations and practical examples (where required).

Module 1

A brief overview about various topics covered in the first module is given below:

Using the Right Charts

In this chapter, Justin highlighted the significance of five-day charts. He explained, with the help of examples, how an incorrect chart (having Sunday candles) may ruin your technical analysis.

Setting Up Your Charts

Here the coach teaches you how to set up a chart, i.e. selecting colors for different candles, background and bars.

Currency Pairs to Watch

Justin shared a list of 26 currency pairs that he considers best for trading. He also gave some suggestions to newbie traders about the selection of a pair. We did think it was weird he is recommending 26 pairs that beginner traders should watch. We felt this was a bit overboard since most beginner traders cannot effectively monitor so many pairs.

Module 2

The second module is all about choosing timeframes.

Timeframes

In this chapter, Justin explains the significance of only using higher timeframes, which we felt put him into a specific ‘camp’ of mentors teaching the same thing.

Common Objections to Trading the Higher Time Frames

Here Justin took a look on commonly used justifications for using smaller timeframes such as “I don’t have enough money to trade the higher time frames”, “Trading higher time frames is boring”, etc. We didn’t find any compelling reasons here, but felt it was an honest attempt.

Module 3

This module talks about identifying daily levels with the help of various price action methods.

Using Weekly Pin Bars to Identify Daily Levels

In this lesson, Justin teaches a technique about using weekly pin bars for daily key levels. The lesson also consists of a short video.

Dynamic Support/Resistance

The mentor explains how moving averages can be used to identify dynamic support and resistance levels. The lesson covers everything about moving averages. He does use the same moving averages as Nial Fuller (from Learn to Trade the Market), but also adds a few more.

Price and Time

In this lesson, Justin touches on swing analysis and how price action approaches a level, but there is not much depth here.

Identifying Horizontal Levels

This lesson consists of two videos in which Justin demonstrated various methods for identifying key horizontal support and resistance levels.

Module 4

The fourth module covers everything about the pin bars. Following are the main lessons of this module:

Anatomy of a Pin Bar

In this lesson, Justin teaches the characteristics of qualified pin bars with the help of a graphical illustration.

Pin Bar Entry and Exit Strategies

Here the coach explains methods for entering and exiting the market while trading pin bars. He showed everything with the help of good graphical illustrations.

Trend Line Breaks

Justin explains the importance of trend lines in price action trading and how trend line breaks can provide useful PA info.

Module 5

This module is about inside bars. The main lessons included in this module are:

Anatomy of an Inside Bar

In this lesson, Justin graphically explains the features and characteristics of valid inside bars.

Rules of Trading Inside Bar Setups

This lesson covers the rules that should be followed while trading the inside bar trade setups. The rules are explained with the help of examples and graphical illustrations.

Inside bar entry and exit strategy

In this lesson, Justin explains how to trade inside bar setups. He illustrated various entry and exit strategies with the help of charts.

Module 6

In this short module, Justin covers everything about the confluence levels and their effectiveness in price action trading. The following are the two detailed lessons included in this module.

Price Action and Confluence

In this lesson, Justin discusses the combination between price action and confluence and how to use it.

The Pillars of Confluence

Here, Justin explains the main confluence factors that should be considered before deciding whether a trade setup is of any worth or not.

Module 7

This module talks about the risk management strategies that you may use to improve your profit potential. The module consists of the following two lessons:

A Proper Risk-Reward Ratio

This lesson describes the importance of risk-reward ratio and how to figure it out for a particular trade.

Proper Risk to Reward Ratio: Case Studies

In this lesson, Justin elaborated on the concept of proper risk to reward ratio with the help of different case studies.

Module 8

In this module, Justin is talking about trend analysis. This module comprises of the following lessons:

Trends and Timeframes

Here Justin teaches how to use various timeframes while identifying a trend for potential trade setups.

Highs and Lows

In this lesson, the coach explains how a trend can be identified visually just by analyzing swing highs and swing lows.

Module 9

Justin has specified module 9 for various advanced level lessons and continues to add new lessons periodically. Presently, you will find these two lessons in this module:

Measured move

This lesson states what a measured move is and how you can use it to predict future moves in a price pattern, although we’ve seen little evidence to support the concepts.

Wedge Breaks

In this lesson, Justin teaches how to trade a wedge break. The lesson contains a short video that practically demonstrates the wedge trading. We really didn’t find much difference here than is typically found in any google search.

SIZE: 47 MB

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course: Falconfx – Falcon FX Pro

1 review for Daily Price Action by Justin Bennett

Add a review Cancel reply

Related products

Forex - Trading & Investment

Forex - Trading & Investment

Forex - Trading & Investment

Pristine – Oliver Velez – Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

Forex - Trading & Investment

Pristine – Oliver Velez & Greg Capra – Trading the Pristine Method. The Refresher Course – I & II

Forex - Trading & Investment

Nick Van Nice & John Sheely – Master CTS Swing Trading (Video & Manual)

Forex - Trading & Investment

Mike McMahon – Professional Trader Series DVD Set (Full) (tradingacademy.com)

Forex - Trading & Investment

Trevis Trevis –

Welcome to Sala Shop, we are here to provide everything to learn and improve this life…encourage you to check clearly the course