I created the financial models behind Foresight so early-stage entrepreneurs can spend less time on finance and more time on their products. I’ve been building and helping entrepreneurs build financial models for startups since 1998. More about my story here.

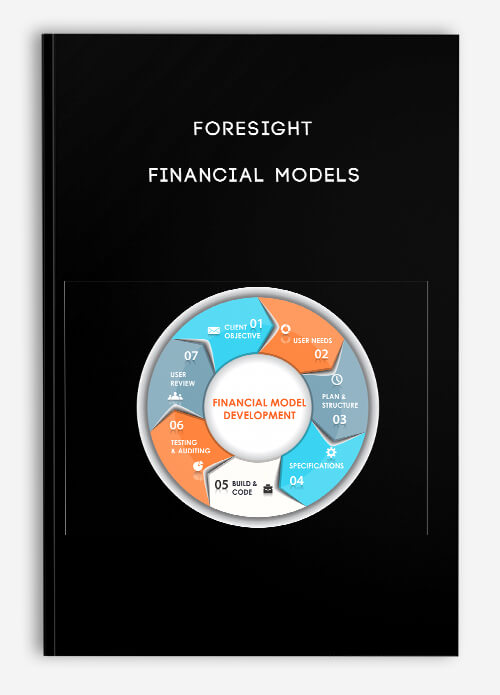

Foresight – Financial Models

$425.00 $77.00

Product Include:

File size:

Category: Financial Development Course

Tag: Foresight - Financial Models

Foresight – Financial Models

**More information:

Get Foresight – Financial Models at Salaedu.com

Description

STANDARD FINANCIAL MODEL V2

BEST SELLER USED BY THOUSANDS OF ENTREPRENEURS TO BUILD COMPREHENSIVE, FIVE YEAR FINANCIAL AND OPERATIONAL FORECASTS FOR BUSINESS PLANNING AND FUNDRAISING. FORECAST YOUR REVENUES, OPERATING EXPENSES, USERS, CASH BUDGET, FINANCIAL STATEMENTS, FUNDING, CAP TABLE, AND VALUATION IN UNDER TWO HOURS.

- The Standard Financial Model is built for businesses with the need to create a comprehensive five year forecast (covering monthly, quarterly and annual results) for fundraising or business planning.

- Built for businesses with subscription, transaction, or advertising business models, covering SaaS, ecommerce, marketplaces, apps, advertising, hardware, software, and more.

- Accounting background not necessary; the model asks you questions about operational concepts such as prices, growth, conversion rates, etc. and handles all the accounting and financial statement generation automatically.

- Start from scratch, or import your historical financial data.

- Forecast your revenues, operating expenses, users, cash budget, financial statements, funding, cap table, and valuation in under two hours.

- Pre-seed or seed stage companies looking to create three year forecasts with simpler revenue projections, consider the Starter Financial Model.

- Instant download, use in Microsoft Excel™, Google Docs™, and other spreadsheet programs.

- Everything can be modified to add in your own unique revenue calculations, as all formulas and cells are completely open and unlocked.

- Purchase one-time, download instantly, customize however and whenever you want. Any updates to the model are emailed to you or can be re-downloaded anytime for free.

- All businesses, startups to growth-stage, tech and non-tech.

- Works for companies starting from scratch as well as companies with multiple years of historical operational and financial data that they want to use in reporting and forecasting.

- Create anything from a simple 12 month cost budget up to a detailed, 6+ year forecast of users, revenues, financial statements, valuation, capitalization, and exit.

- Works for multiple types of business models, but can also be adapated to your specific business needs.

- Subscription-based businesses (SaaS, enterprise SaaS, B2C SaaS, subscription commerce, content subscriptions, etc.)

- Transaction-based businesses, including direct retailers, apps, for one-time or recurring transactions.

- Marketplaces, including marketplaces like Etsy and services marketplaces like Uber.

- Advertising-based businesses like website publishers selling ads directly or through ad exchanges.

- Combinations of the above, including hardware companies with software subscriptions (Fitbit and others), subscription services with ecommerce add-ons (Harry’s, Amazon Prime, and more), companies with free advertising-supported freemium levels alongside paid subsciptions and potentially additional transactions, etc.

- README. Description of model, layout, and how to use it.

- Outline. Flowchart of how the model works, with a description of every sheet and their goals.

- How To. Documentation that details of each sheet and how the inputs and calculations work. Assumptions and calculations are noted and explained throughout the model.

- Assumptions. Over 200 potential assumptions to use, more about assumptions structure here. Assumptions are structured on one page, with the option to alter them on individual time periods on each calculation sheet.

- Summary. Key operational and financial metrics organized in a clean summary, reported over 5 years, built to be easily customizable for your key metrics and timeframes.

- Key Reports. Charts and tables of costs, active users (optional), cash on hand, revenue and revenue growth rate, net income and cumulative net income, margins, sources and uses, and more.

- Costs. Simple yet robust methodology for creating a cost budget for up to 60 months of operations, including a detailed hiring plan, while also automatically handling the accounting treatment of the expenses. Set hiring, salaries, roles, and when to hire, including a method to automatically calculate hiring as the company scales. Flexible inputs to input all costs easily on a month by month basis. Expenses can be allocated to key expense areas and labled for accounting treatment as SG&A, COGS, or CAPEX.

- Users and Revenues. User acquisition is broken out by four paid channels, two organic channels, and includes sections for viral growth and business development, and all channels can be mapped to your Google Analytics or actual data. User retention is modeled by cohorts, subscriptions, and straight manual inputs if desired. Revenue forecasts for subscription, SaaS, ecommerce, marketplaces, advertising, and app-based businesses. Key user and customer calculations by monthly cohorts, subscriptions, or manual inputs, and revenue calculations for each available (and optional) revenue model. For businesses requiring less comprehensive revenue forecasting methodologies, consider the Starter Financial Model.

- Statements. Consolidated financial statements, including income statement, balance sheet, and statement of cash flows. Includes a detailed cash flow forecast that automatically forecasts funding requirements based on a simple assumption of how many months expenses to raise money for. Use this sheet for forecasting only, or bring in your historical financials to show either a mix of the past and the future, or to compare budgets to forecasts.

- Cap Table. (Optional) The cap table in the Standard Model v2 is the Cap Table Model integrated into the cash flows of the business, mapping forecasted expenses and net burn to needed fundraising to estimated funding rounds by size and date. Models equity, convertible note and SAFE financing rounds, mapped to expected financing dates and amounts. Exit waterfall calculates distributions of proceeds to investors in the case of a sale, and calculates returns to all shareholders.

- Valuation. Valuation is aided with built-in structures for discounted cash flow, VC Method, and market comparables valuation methodologies. Valuation can be tied to exit value in cap table providing seamless projection of returns to investor classes and shareholders.

- External Data. Sheet used for importing financials from Quickbooks, Xero, Freshbooks, and other accounting software.

- Changelog. Details of all edits to the model since release, by version number.

- Instant Download – one .xlsx Excel file. Immediately after purchase you will receive a download link and an invoice for your records.

- Updates to the model are free, and the model can be re-downloaded at any time.

- Credit/Debt Cards and PayPal accepted; all transactions are SSL secured and no payment details are stored by Foresight (see here to understand the details behind our transaction provider, their security and how they never store payment details).

- All inputs and formulas are clearly labled; all formulas are open for editing and can be changed by user (i.e. no locked cells).

- Works for any currency; Foresight models have been used by entrepreneurs from over 116 countries.

- Use in Microsoft Excel™, Google Docs™, and other spreadsheet programs.

- If applicable, VAT is extra.

- Bulk license purchases available, details here.

- Purchase signifies acceptance of terms and privacy policy.

“THE FORESIGHT FINANCIAL MODEL IS VERY COMPREHENSIVE AND COVERS ALL THE MAIN DRIVERS FOR A VARIETY OF BUSINESS MODELS. WHAT I FOUND REALLY HELPFUL TOO WERE THE HELP GUIDES AND TIPS THAT TAYLOR INCLUDED IN THE BEGINNING OF THE MODEL TO HELP YOU REASON THROUGH COMING UP WITH YOUR ASSUMPTIONS AND THINKING ABOUT YOUR BUSINESS AS A WHOLE AND WHAT VCS LOOK FOR. FINALLY, TAYLOR WAS GREAT TO WORK WITH. HE PICKED UP OUR BUSINESS MODEL VERY QUICKLY AND PROVIDED INSIGHT ON BUSINESS DRIVERS AND ASSUMPTIONS THAT I HADN’T THOUGHT THROUGH YET – WHICH REALLY HELPED ME REFINE MY THINKING IN ORDER TO CREATE A MORE SOPHISTICATED AND NUANCED MODEL.”

Jude Chiy, Founder, HelloHealthy

MODEL + GET STARTED

- Model, downloadable immediately.

- One-time purchase, model updates are free.

- Free email customer support.

- 1 Hour of assistance in completing the model, customization and review. Focus is on structuring and adjusting inputs for your business, and refining unit economics, cost budget, financial statements, and financing strategy.

- Additional customization may be necessary depending on your business; to be determined and billed separately.

Financial Development Course

Financial development means some improvements in producing information about possible investments and allocating capital, monitoring firms and exerting corporate governance, trading, diversification, and management of risk, mobilization and pooling of savings, easing the exchange of goods and services.

1 review for Foresight – Financial Models

Add a review Cancel reply

Related products

Financial Development Course

Rated 5.00 out of 5

$17.00

-76%

Financial Development Course

Rated 5.00 out of 5

-90%

Financial Development Course

Rated 5.00 out of 5

-76%

Financial Development Course

Rated 4.00 out of 5

-74%

Financial Development Course

Rated 4.00 out of 5

-80%

Financial Development Course

Rated 5.00 out of 5

-89%

Financial Development Course

Rated 5.00 out of 5

king –

We encourage you to check Content Proof carefully before paying.“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.Thank you!