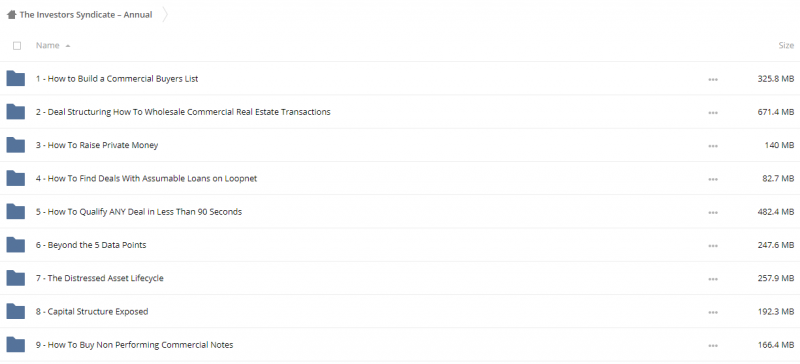

The Investors Syndicate – Annual

$997.00 $92.00

The Investors Syndicate – Annual

Archive : The Investors Syndicate – Annual

- Easily raise the capital needed to do 7 and 8 figure deals?

- Swoop in and take control of distressed offices or multifamily buildings?

- Flip high dollar deals for massive profits, without ever using a dime of your own money?

- Residential is WAY more competitive.

- Thinner deal margins.

- Residential investors are shackled at the ankles with federal rules and regulations.

- It’s much easier to raise capital for commercial deals than for residential ones.

- Residential is a much more hostile environment.

- Scalability.

- The belief that residential investing involves less hassle, less time invested, and less paperwork is flat out WRONG!

- Doing deals in residential : a challenging federally regulated and constricting environment where you tie up your cash for months on end, thus limiting the number of deals you do with just a mediocre payoff…

- Or in commercial : wisely building a viable high fee, high margin, high cashflow, high profit business while at the same time creating true long term wealth?

- Owners are behind on payments…

- The property is in foreclosure or bankruptcy…

- It’s an REO at the bank…

- Repairs are needed to get the building back to black…

- Sponsors are silently crying for bridge financing as their loans come due…

- Owners have no clue how to raise capital to complete the project…

- $1 Million (or more) is needed to close the deal…

- Banks are holding the defaulted note and need to get it off their books…

- Partners want to be taken out of the deal… IMMEDIATELY, IF NOT SOONER…

- Loans need to be paid off because they’re due or past due…

- Professional Network

- Intellectual capital

- Training and experience

And Expert Network Center

You guessed it… Bad information!

- The stuff that actually WORKS!

- The stuff that builds your business!

- The stuff that puts money in the bank!

- The stuff grows your wealth for years to come!

- Capital Formation: How to Raise Capital ON DEMAND for your deals

- Asset Arbitrage: What the institutional players call “wholesaling” deals

- Deal Making and Gamesmanship: Matching capital with the asset

- Capital Placement: Placing capital from Wall Street firms into YOUR deals

- Highly Paid Consulting: High Paid or Highly Feed? Your choice…

- Deal Structuring: Profit big time by creating solutions when no one else can

Get The Investors Syndicate – Annual on Tradersoffer.com

The Investors Syndicate – Annual Download, Annual Download, Annual Groupbuy, Annual Free, Annual Torrent, Annual Course Download, The Investors Syndicate – Annual Review, Annual Review

Internet Marketing Course

Digital marketing is the component of marketing that utilizes internet and online based digital technologies such as desktop computers,

mobile phones and other digital media and platforms to promote products and services. Its development during the 1990s and 2000s,

changed the way brands and businesses use technology for marketing. As digital platforms became increasingly incorporated into marketing plans and everyday life,

and as people increasingly use digital devices instead of visiting physical shops, digital marketing campaigns have become prevalent,

employing combinations of search engine optimization (SEO), search engine marketing (SEM), content marketing, influencer marketing, content automation,

campaign marketing, data-driven marketing, e-commerce marketing, social media marketing, social media optimization, e-mail direct marketing, display advertising,

e–books, and optical disks and games have become commonplace. Digital marketing extends to non-Internet channels that provide digital media, such as television,

mobile phones (SMS and MMS), callback, and on-hold mobile ring tones. The extension to non-Internet channels differentiates digital marketing from online marketing.

More Course: INTERNET MARKETING

Outstanding Course: https://tradersoffer.forex/product/bob-proctor-living-the-legacy/

Be the first to review “The Investors Syndicate – Annual” Cancel reply

Related products

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Shop of Moxie – The 2015 Six Appeal Process from Ash Ambirge

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Reviews

There are no reviews yet.