On-Demand Options Education by Sang Lucci

$32.00

On-Demand Options Education by Sang Lucci

**More information:

Status:

Sale Page

Get On-Demand Options Education by Sang Lucci at Salaedu.com

Welcome to Sang Lucci’s On-Demand Options Education. This is a 15+ hour on demand course that teaches options using a unique strategy of momentum trading large cap weekly and monthly options, while helping to identify a trading style that fits your personality, financial goals, and capital base.

Sang Lucci’s On-Demand Education is for the trader seeking to learn how to aggressively trade large cap stocks and options and find the method that specifically suites his or her personal goals.

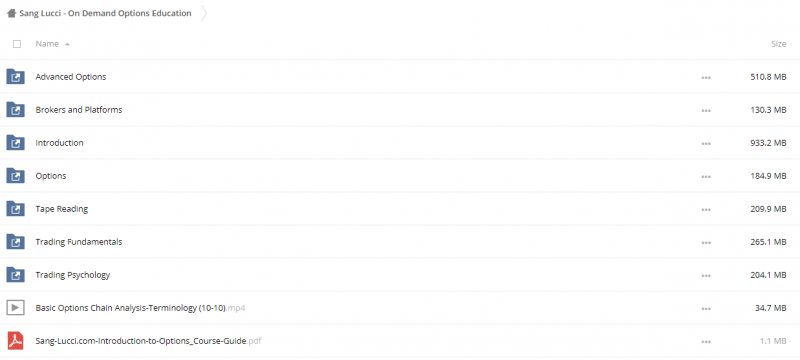

This course offers four, seventy five minute class recordings from our Introduction to Options course along with over fifty 15-minute video sessions addressing everything from options basics to the psychology of trading.

Consider it the all access pass to Sang Lucci’s options and Tape Reading expertise that allows you to choose what and when you want to learn.

1) On-Demand access to Sang Lucci’s Four Day Options course

•Sang Lucci’s Four Day Options course provides a crash course on trading basics, options and Sang Lucci’s methods, trading platforms and brokers, and trading psychology.

•Receive a free, 60-page digital course guide along with the class recordings.

2) Sang Lucci’s Additional Educational Videos

•These shorter 10-15 minute videos target a single topic. They focus on the fundamentals like, “What is a Call option?” as well as advanced subjects like, “How Sang made $40,000 shorting Goldman Sachs Puts”. You can start with the first video and end with number fifty or skip around to the topics that interest you most.

3) One-On-One Consultation

•Sang Lucci provides each members of the on-demand educational course with a 30 minute long, one-on-one consultation to answer questions, analyze your current watchlist, find the right brokerage for your trading style and help you find a method that suites your personal goals.

On-Demand Course Curriculum: Introduction to Options

Class 1: Trading Basics

•Understanding the Auction Process

•Candlesticks

•Viewing and Analyzing Charts

•Adjusting Time frames on Charts to Provide Insight

•Profiting from Market Conditions Using Different Types of Trades

•Picking Options

•Understanding Sentiment

•Capitalizing on Supply/Demand Dynamics

•Technical Analysis and Indicators

•RSI, VWAP, MA, etc.

•Lagging Indicators

•Building Your Watch List

•Breaking Down Sang Lucci’s Watch List

Class 2-3: Options

•Why We Trade Options In the First Place

•Options 101

•Reading an Options Chain

•Sanglucci’s Equation for the Pricing Options

•Volatility and How to Profit Off of It

•Choosing the Underlying Stock

•Calls vs. Puts

•Picking Your Strike Prices

•Traits of In the Money vs. Out of the Money

•Expiration Dates

•Weekly Options and Advantages Over Monthlies

Class 4: Choosing a Trading Platforms and Broker

•Priorities for Choosing Platform (especially for options)

•Adjusting Settings to Maximize Performance

•Employing Multiple Chart Time frames

Class 5: Trading Psychology

•Personal

•Challenging Your Fears

•Taking Losses

•Managing Winners

•The Value of NOT Trading

•The Importance of Building Your Own Trading style and Identity

•Market

•How to Manage and Even Capitalize on

•Headline Risk

•Anticipating Moves and Avoiding Setups

•Trading Around Earnings

1 review for On-Demand Options Education by Sang Lucci

Add a review Cancel reply

Related products

Forex - Trading & Investment

Michael Parsons – Channel Surfing Video Course (Manual,Video)

Forex - Trading & Investment

Justine Williams-Lara – Counting Elliott Waves. The Profitunity Way DVD (with Russian subtitles)

Forex - Trading & Investment

Forex - Trading & Investment

Options University – Technical Analysis Classes (Video, Manuals)

Forex - Trading & Investment

Paul Lemal – Bottom Springers. Bonsai Elite WaveTrader Course (8 DVDs & Manuals)

Forex - Trading & Investment

Mike McMahon – Professional Trader Series DVD Set (Full) (tradingacademy.com)

Trevis Trevis –

We create this shop with the mission: Bring the courses to 500 millions of people in the world, to help them awake their power and change their