Rick Ackerman – Advanced Tactics Course (GroupBuy Course)

$1,000.00 $150.00

Rick Ackerman – Advanced Tactics Course

Dear Trader,

Could I teach your granny how to trade? You bet! I will stake my reputation on it. More on this seemingly outrageous claim below.

But first let me tell you about Advanced Tactics of the Hidden Pivot Method, a radically revised version of the course I have been teaching for more than 20 years. It contains the most powerful trading secrets I have ever shared. Spend just three hours with me on Monday evening, May 22, and you will possess a simple way to crank out low-stress winners all day long.

The ‘reverse-pattern’ set-up that I will teach you works so well, in fact, that I’ve decided not to market it. That’s right: Only longtime subscribers who have taken one or more of my courses in the past will receive an invitation to attend. The information is just too valuable to share with the trading world.

I had considered putting students under a non-disclosure agreement, but once you’ve seen what you can do by combining ‘voodoo’ numbers, ‘mechanical’ set-ups and reverse-pattern (rABC) triggers, you will not want to share the details with anyone.

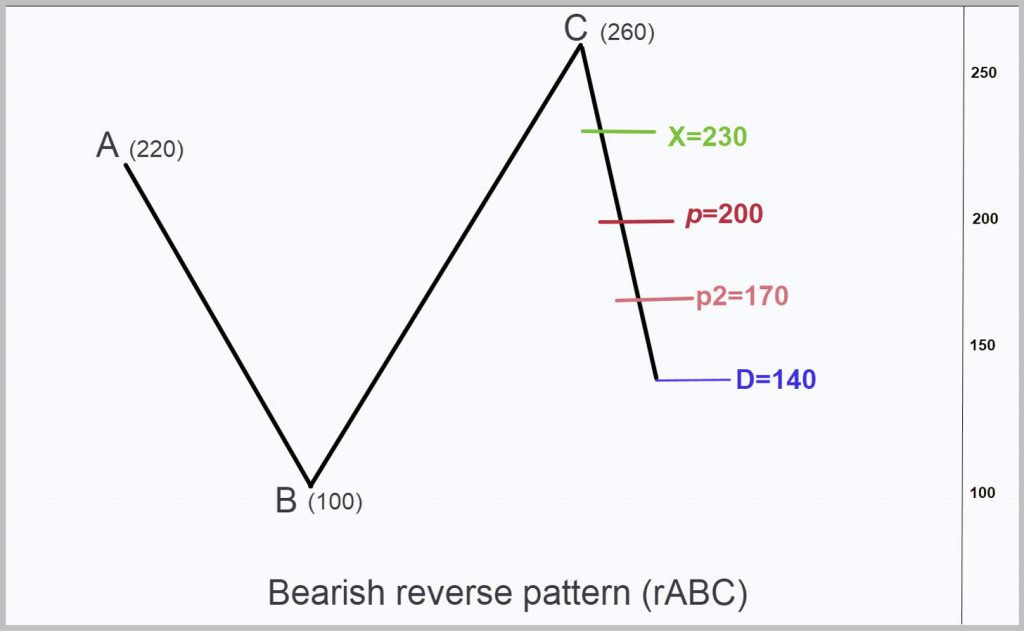

Flipping ‘ABCD’

I’ve been refining rABC tactics for more than two years but only recently had an epiphany that solved two crucial problems that have rendered conventional ABCD patterns nearly obsolete: frequent stop-outs and uncertain reversal points.

I rarely use the old-style pattern anymore because overpopularity has killed its effectiveness. It has become a consistent loser.

Instead, I’ve flipped ABCD upside down and inside out to produce a visually obscure hybrid that trades with a level of risk control, accuracy and reliability that will astound you. Moreover, I am confident that few outsiders have caught on, since rABC set-ups continue to work almost magically — and easily.

So easily, actually, that you won’t have to search for long to find profitable trades. With just a little practice you’ll be able to select a trading vehicle at random and find a quick, easy money-maker in just a minute or two.

Thinking Small

The method is far removed from our habitual focus in the past on leveraging important tops, bottoms and drum-rolled targets. The emphasis has shifted toward trading mainly small, underwatched opportunities that crop up on the lesser charts all the time.

Sometimes your trades will entail hitching a relatively brief ride up or down. But it can be lucrative if you merely step up your size. Indeed, a unique and very appealing aspect of trading is that any tactic that is making you a steady $100 a day will scale up to $1,000 effortlessly.

Scared of losing your shirt while you learn? We’ve all heard stories about novices who lost five or even six figures experimenting with trading systems that supposedly had made others rich.

Don’t worry. Using the advanced tactics you’ll learn in this course, you can get started with as little as $1,000. And your losses even in a bad month are unlikely to exceed $30-$50! That’s because you’ll be able to trade just a few shares at a time while you learn, using stops as tight as 5-10 cents. Do the math – and relax!

Most of your entry triggers will use the hybrid pattern, but on charts of small degree. This is called “camouflage trading,” and it will enable you to hone your skills with a $2,000 stock like Chipotle until you have accumulated enough capital to trade 100-share lots.

Practice makes perfect, but it shouldn’t cost you an arm and a leg to become consistently profitable.

Embracing the ‘Discomfort Zone’

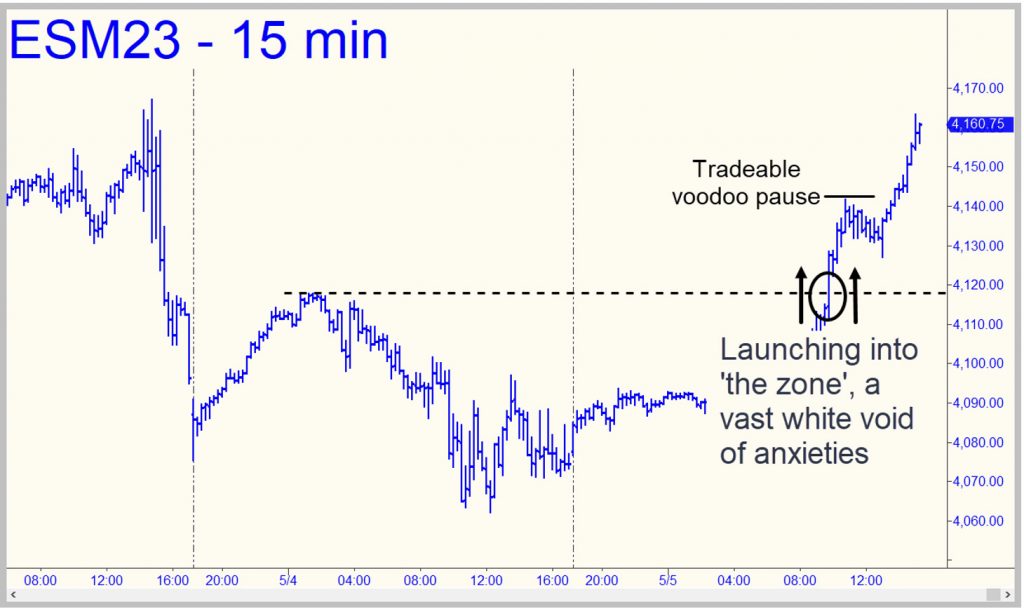

A paradox of trading is that the biggest, quickest winners typically begin in places that can make one’s stomach churn. Yours might churn too, at least at first, since you’ll be learning how to initiate trades in what I call the “discomfort zone.”

You’ll soon discover that coping with a little discomfort is worth it, since you’ll be able to initiate trades in places where you are unlikely to bump heads with the competition. Jump in where others fear to tread and you will get a taste of the quick profits that flow to those who have learned how to think and act boldly against their gut.

Looking for comfortable trades is for losers. It implies surfing a trend that has become too obvious to too many. When that happens, Mr. Market invariably causes the trading vehicle to become diabolically and painfully evasive. If it were easy, everyone who has taken up trading would be a multimillionaire.

Voodoo Trading

Let me tell you a little more about “voodoo” set-ups. The tactic comes from a simple idea that I have never taught before, even to students who have been attending Wednesday tutorial sessions diligently.

Have you ever looked at a painting on a wall that was slightly crooked? It turns out that your eye is capable of detecting a skew as small as a few millimeters. If Mona Lisa were just a tad slanted in the Louvre, visitors would either know it for a fact, or would sense it subliminally as a visual annoyance.

Similarly, a price spike into a chart’s discomfort zone can vex the eye of the trader who is poring over a chart in real time. But would you believe that these spikes often peak in places that can be precisely predicted without using arithmetic? You’ll need to try it yourself to understand how a peculiar visual effect can translate into easy trading bets that risk little, even in violent markets.

Once you’ve seen how it works in dozens of eye-popping charts I’ve prepared, you’ll be able to identify voodoo set-ups yourself without difficulty. This will enable you to transform what most other traders experience as high-anxiety moments into a steady flow of income.

And because opportunities to employ the tactic are easily discoverable and relatively numerous, slow or profitless days will become increasingly rare.

Profits from Near-Misses

A particularly appealing feature of voodoo numbers is that they do not have to be hit exactly in order to work. If a rally overshoots one or falls somewhat shy, the trade simply won’t trigger.

And if the “Mona Lisa effect” should cause a trade to play out perfectly, as often occurs, you’ll enjoy the exhilaration of being a step ahead of the crowd. Few things are more pleasurable in trading than being on board for a quick, profitable move that has whipsawed everyone else. That is what “discomfort zone’ trading will enable you to do — consistently and with relatively little stress. Quite often, you will even make a small profit when you have guessed wrong about where to jump in.

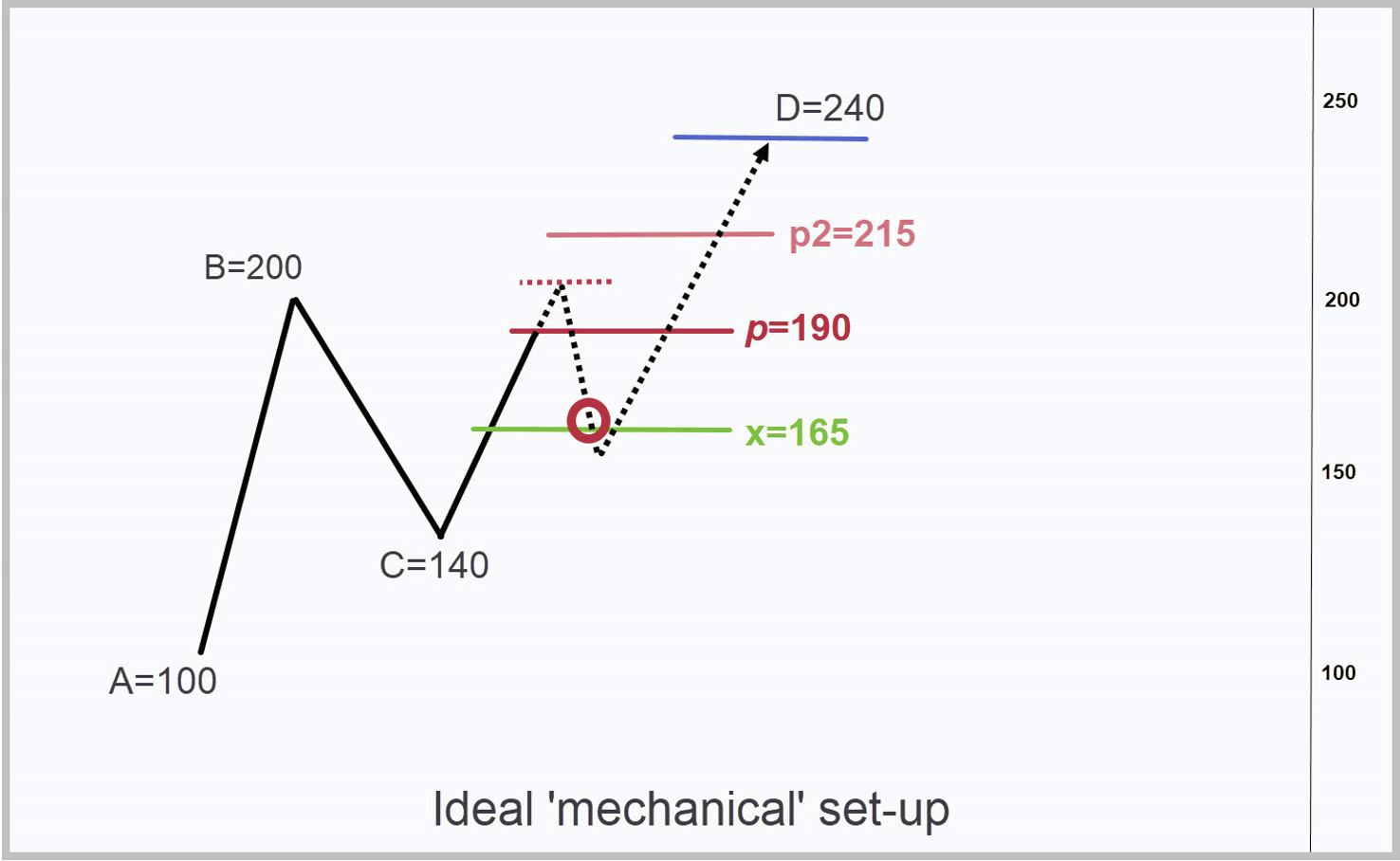

Planting ‘c’ Is the Whole Trick

Making money with this system boils down to knowing where to plant the point c high or low of an rABC pattern. That’s all there is to it.

The course identifies no fewer than eight such places, but you could probably make a good living using just one or two of them. Specifically, you could anchor your point c: 1) at D targets of gnarly patterns; 2) slightly above or below prior peaks or lows; or 3) at voodoo numbers.

All methods are covered in great detail in the course so that, yes, even your grandmother could start banging out winners after just a few weeks of practice.

My Scholarship Offer

To test this seemingly far-fetched claim, I will offer the course free to a person who has either never traded or who has traded for years with poor results. Just send me the name of your nominee along with some pertinent details about the person and I will select the recipient of the full scholarship, which will include private consultations valued at $400 per hour.

You may nominate yourself if you have tried your hardest for years and failed to become profitable.

Once I’ve brought the scholarship winner up to speed, I expect him or her to be able to make a living solely from trading.

That could be a godsend for your favorite Walmart greeter, aging barista, part-time librarian, taxi driver, short-order cook or museum docent. The person should be at least moderately proficient at using a computer, since executing trades smoothly on an electronic trading platform can be even more challenging than identifying the opportunity.

How to Reserve a Seat

I mentioned above that I am not planning to promote this course to outsiders, only to loyal Rick’s Picks subscribers. If you have received this invitation, it means you have been with me for quite a while. That is why I am offering it at $699, a rock-bottom price that I can promise will never be repeated or undercut. Anyone invited to take the course after its debut later this month will pay at least twice that.

Sign up now and you will also have a chance to purchase a one-hour private consultation with me for $300, a 25% discount; or for $200 if you don’t mind sharing a session with another student.

One additional option will be available to you on the sign-up page. If you would like to refresh your knowledge of basic Hidden Pivot skills, you can take the original Hidden Pivot Course at a discount before or after taking the advanced course. This will be free to anyone who has paid for the original course within the last three years and $400 for everyone else.

Additionally, there will be two extended Q&A sessions that have yet to be scheduled. Both will be recorded, Wednesday tutorial sessions will continue as usual, but the class will be closed to those who choose not to take the advanced course. Those students will still be able to receive tutorial instruction, but it will be via a separate class that will be offered, at least for the time being, at regular intervals.

Sign up now and circle the evening of May 22 on your calendar. I can promise that what you will learn that night will dramatically reshape the way you think about trading. If you want to make a living at it or supplement your income with as little as an hour or two of work each day, I would strongly recommend taking Advanced Tactics of the Hidden Pivot Method.

Be the first to review “Rick Ackerman – Advanced Tactics Course (GroupBuy Course)” Cancel reply

Related products

Forex - Trading & Investment

Pristine – Oliver Velez – Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

Forex - Trading & Investment

Pristine – Oliver Velez & Greg Capra – Trading the Pristine Method. The Refresher Course – I & II

Forex - Trading & Investment

Michael Parsons – Channel Surfing Video Course (Manual,Video)

Forex - Trading & Investment

Justine Williams-Lara – Counting Elliott Waves. The Profitunity Way DVD (with Russian subtitles)

Forex - Trading & Investment

Options University – Technical Analysis Classes (Video, Manuals)

Forex - Trading & Investment

Reviews

There are no reviews yet.