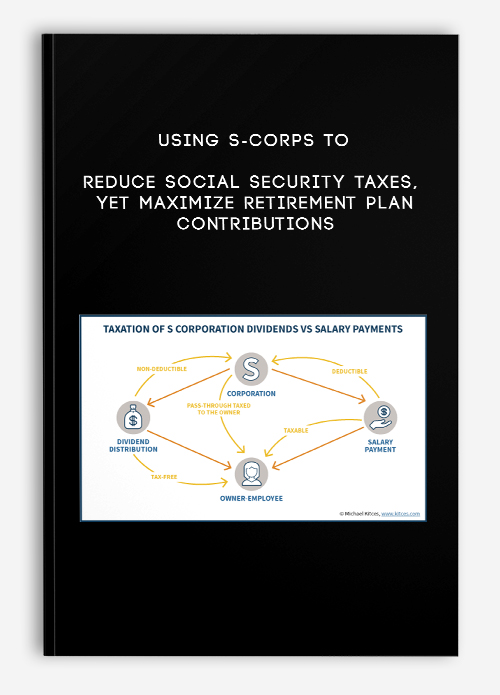

Using S-Corps To Reduce Social Security Taxes, Yet Maximize Retirement Plan Contributions

$25.00 $13.00

Using S-Corps To Reduce Social Security Taxes, Yet Maximize Retirement Plan Contributions

Get Using S-Corps To Reduce Social Security Taxes, Yet Maximize Retirement Plan Contributions on Salaedu.com

Description:

Income subject to Social Security taxes is known as “earned income”, which can be in the form of salaries from corporations or net business income from single proprietorships and partnerships. (Note: While earned income is subject to Social Security taxes, it is also eligible for retirement plan contributions, whereas non-earned income is not eligible for plan contributions.)

Real Estate course

What is real estate? Learn about Real Estate

Real estate investing involves the purchase, ownership, management, rental and/or sale of real estate for profit.

Improvement of realty property as part of a real estate investment strategy is generally considered to be a sub-specialty of real estate investing called real estate development.

Real estate is an asset form with limited liquidity relative to other investments,

it is also capital intensive (although capital may be gained through mortgage leverage) and is highly cash flow dependent.

If these factors are not well understood and managed by the investor, real estate becomes a risky investment.

More Course: REAL ESTATE INVESTING

Outstanding Course: 90 Days To $5K by Edna Keep

1 review for Using S-Corps To Reduce Social Security Taxes, Yet Maximize Retirement Plan Contributions

Add a review Cancel reply

Related products

-93%

Internet Marketing Courses

Rated 5.00 out of 5

-93%

Internet Marketing Courses

-84%

Internet Marketing Courses

Rated 5.00 out of 5

-93%

Internet Marketing Courses

Rated 5.00 out of 5

-91%

-93%

-93%

-82%

Internet Marketing Courses

king –

We encourage you to check Content Proof carefully before paying.

“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”

If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.

Thank you!