Subtotal: $37.00

Commercial Capital Syndication from Dandrew Media

$1,497.00 $142.00

Commercial Capital Syndication from Dandrew Media

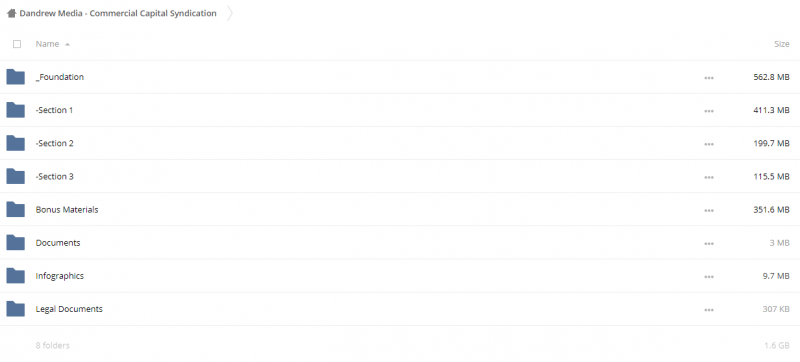

Archive : Commercial Capital Syndication from Dandrew Media

Politics aside, we all took note during the 2012 Presidential Election when Mitt Romney revealed that he had close to $100M in his IRA. Investors worldwide are trying to replicate his success. Dandrew Media’s Capital Syndicator is a revolutionary tool exposing Wall Street’s insider secrets for wealth creation. It’s time to learn how to make “Mitt Romney Money” by investing smart.

The real estate market is widely seen as being in distress and on sale to the rest of the world. This coupled with persistently low interest rates, a lack of trust in the stock market and an epidemic of financial frauds make real estate the go-to asset for the $14 trillion retirement savings market.

The government is forcing regular investors to take risk by continuing to keep rates extremely low and thrusting them in the stock market to get any form of a return whatsoever. 1% in the bank with a cool million in savings will only give you poverty-like annual income of 10k per year.

Investors want to put their savings in the hands of someone they know and trust. Someone like you. It’s time to think like a bank and learn how to pool capital together. It’s time to make real money and Capital Syndicator is your answer. Investing in yourself today; is investing in your future.

Capital Syndicator reveals to the owner-operator how to pool capital together from targeted investors who want to participate passively alongside qualified real estate operators offering them opportunities that they might not have been able to get into individually. Key strategies are taught throughout this 71 page digital manual, showing Intermediaries how to syndicate just about anything. Whether you need to fund your deal or pool debt for your deals, Capital Syndicator is your number one resource for raising funds.

“Donors don’t give to institutions.

They invest in ideas and people in whom they believe.”

– G.T. Smith

Intermediaries Will Learn:

Syndication Basics

Intermediaries will learn the basics of real estate syndication and how this widely used Wall Street strategy can build wealth for both you and your investors. Profitable techniques used by an inner-circle of investment bankers are revealed aligning you for a life of prosperity, respect and a career you can count on.

Forming a Business Entity

Choosing the correct form of business entity will directly impact your financial future. A variety of methods are discussed giving Intermediaries the tools they need to develop a syndication strategically structured for continued success.

A Foundation for Success

Intermediaries will learn how to finance real estate syndicates positioning the entity to see immediate results. As in most successful deals, it’s all about how it is structured. Capital Syndicator will show you exactly how you need to form and document a syndicate.

Syndicate Operations

Being able to effectively manage the syndicate will determine whether or not you can achieve greatness in this industry. We’ll show you essential best practices for running your business smoothly and credibly.

Marketing Essentials

Not knowing how to effectively market real estate syndicates will certainly land you in a catastrophic failure. Dandrew Media’s partners know how this industry works and knows how to network and build relationships. Use our marketing tips and tricks to get your syndicate up and running fast.

Effective Partnerships

Intermediaries must have a thorough understanding of how partnerships should work in a syndicate. Capital Syndicator will walk you through this fragile relationship and discuss the benefits if it’s structured correctly.

Industry Regulations

Understanding state and federal regulations are imperative in this business. You will leave this tutorial having an in-depth knowledge of all facets of state and federal regulations and how they directly affect your business.

Bonus Material

With the purchase of Commercial Deal Structuring Manual you’ll also receive THIRTEEN bonus Infographics!

Dandrew Media’s Infographics were created with one main goal: To keep our Intermediaries organized by not just telling them “what to do” but to show them exactly “how to do it”. Specially designed to keep our Intermediaries working smarter not harder, each Infographic is the ultimate desktop resource that you need to keep your pipeline full, deals progressing and successful closes. Our colorful, user-friendly Infographics were designed to print out at an impressive size of 17″ x 11″ and hang on your office wall.

Infographic:

Syndication Timeline

So, you’ve taken the big leap into the unknown. You’ve finally taken on the prestigious role as a Fund Manager. With this impressive title also comes a great deal of responsibility; after all, you are managing other peoples money. No Fund Manager should dive in head first without this Infographic. Syndication Timeline is your go-to resource to ensure your syndication is wildly successful.

Infographic:

Asset Class Review

Don’t settle for being familiar with commercial real estate practices, become an authority in all aspects of the industry. Asset Class Review is your go-to blueprint comparing the four main asset categories. If you don’t know these assets and their differentiating factors, then you need this informative Infographic hanging in your office.

Infographic:

Commercial Non Performing Note – Issues to Consider

When purchasing a non-performing commercial note there are many issues that every Intermediary must consider. This informative Infographic was developed to ensure that you don’t drop the ball and carelessly make a mistake during the purchase. If you’re working with non-performing notes, you can’t afford to not have this Infographic hanging on your wall. Effective due diligence is the key to every deals success.

Infographic:

Deal Book

We say it over and over: Get Organized! You will never be successful in commercial real estate if you can’t keep your contacts and files organized. Everything needs to be documented and information stored in a systematic, time-efficient manner. Infographic: Deal Book will help you significantly improve your time management and organizational skills.

Infographic:

Deal Structuring – 30k in 30 days

This deal structuring Infographic is no joke. If you follow these five steps you will successfully close a wholesale commercial real estate transaction, making you 30k in 30 days. Enough said.

Infographic:

Different Types of Commercial Real Estate Transactions

You have a commercial project. Now what? Laying the foundation is critical as you begin a career in commercial real estate. Your knowledge of these basics will have a direct correlation to your success and ability to prosper in this line of work. Understanding the different asset classes and financing transactions is where you need to begin your education. Take advantage of this detailed chart and kickstart your commercial real estate career today.

Infographic:

Five Core Functions of a Fund Manager

You’ve decided to make your move as a Fund Manager. Now What? This Infographic was designed to keep you on track, moving forward and staying proactive. Working these five critical functions of a Fund Manager continuously and simultaneously will ensure your syndication is a success.

Infographic:

Funding Lifecycle of a Commercial Real Estate Deal

This is the king of all Infographics! Every Intermediary needs this hanging on their wall. The funding lifecycle of a commercial real estate deal is extremely complex and forgetting one essential step could destroy your deal. From every last detail, this Infographic will take you from pre-qualifying your deal to the closing table.

Infographic:

How to Raise and Syndicate Capital In a Bad Economy

If there is one Infographic that every Intermediary needs than this is it. In this one exceptionally designed poster-sized blueprint you’ll have every piece of information needed to effectively raise and syndicate capital in a poor economy. You will use this one daily!

Infographic:

How to Use Elance to Build Your Pitchbooks

Whether you need to create your first pitchbook or your twentieth, don’t waste your time trying to do it yourself. Elance is a reputable site where freelancers flourish, eagerly awaiting their next project. Why spend days writing a mediocre pitchbook when you can hand it over to a professional copywriter with extensive commercial real estate experience? It’s time for you to learn Dandrew’s Fundraising Fundamentals.

Infographic:

Pyramid of Priority

This Infographic is hands down the most informative blueprint we offer for sourcing deals. It reveals the industry’s best tips and tricks for finding deals and how to build rapport with the people who are sitting on a gold mine. You can’t afford to go one more day without incorporating these techniques into your marketing plan.

Infographic:

Strategies for Starting a New Fund

If you’re starting a new fund it’s imperative that you have the commercial real estate expertise and resources to make the best decisions during each step of the process. This Infographic asks you the tough questions, ensuring that your syndication is on the right course. The strategies revealed in this Infographic will be used for years to come as you build your commercial real estate empire. What are

you waiting for?

Infographic:

How to Build a Qualified Builders List

As you continue your venture in commercial real estate it’s essential that you stay organized. Developing a comprehensive commercial buyers list will save you a significant amount of time and energy. This chart shows you the vital information that you must include on your spreadsheet. Missing one of these integral pieces of information could cost you a lot of time and a missed opportunity.

Get Commercial Capital Syndication from Dandrew Media on Salaedu.com

Real Estate course

What is real estate? Learn about Real Estate

Real estate investing involves the purchase, ownership, management, rental and/or sale of real estate for profit.

Improvement of realty property as part of a real estate investment strategy is generally considered to be a sub-specialty of real estate investing called real estate development.

Real estate is an asset form with limited liquidity relative to other investments,

it is also capital intensive (although capital may be gained through mortgage leverage) and is highly cash flow dependent.

If these factors are not well understood and managed by the investor, real estate becomes a risky investment.

More Course: REAL ESTATE INVESTING

Outstanding Course: Dandrew Media – Commercial Capital Structure Basics Live [76 Video (MP4) + Document (PDF)]

1 review for Commercial Capital Syndication from Dandrew Media

Add a review Cancel reply

Related products

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Internet Marketing Courses

Tube PowerHouse 2.0 from Jon Penberthy

Tube PowerHouse 2.0 from Jon Penberthy

![Copy Hackers [Joanna Wiebe] – Email Copywriting](https://tradersoffer.forex/wp-content/uploads/2017/02/Copy-Hackers-Joanna-Wiebe-–-Email-Copywriting-220x306.jpg)

king –

We encourage you to check Content Proof carefully before paying.

“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”

If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.

Thank you!