Subtotal: $47.00

Ron Legrand – Private Lending

$997.00 $92.00

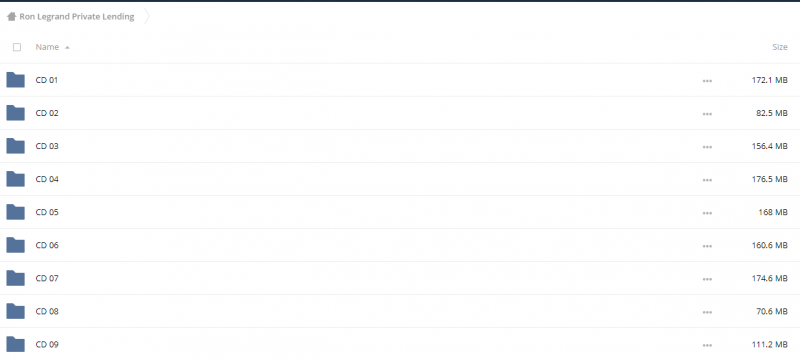

Product Include:[12 CDs (MP3) + 2 Workbooks (PDF)]

File size:1,65 GB

Ron Legrand – Private Lending

**More information:

Get Ron Legrand – Private Lending at Salaedu.com

Description

Getting money to do real estate deals has nothing to do with going to a bank, filling out an application, putting up down payments or waiting to be approved. Smart investors won’t go near banks who want to control their lives and tell them what they can or can’t qualify to borrow.

You Can Get All The Money You Want From People, Not Banks…

And Get It Faster, Easier,

And There’s No Limit To How Much You Can Borrow

When I started in 1982, I had no credit. Well, actually I did, and it was bad. But I found a mortgage broker who’d loan me money based on the equity in the property, not my credit. His name was Al, and he would loan me 60% of its value.

Therefore, my credit was irrelevant. His sole interest was the collateral, not my credit. Sure, the interest was high, but the money was easy to get. No application. No committee approval. No long wait. The loans closed two days after I got an appraisal and…

I Always borrowed More Than I Needed To Buy And Fix The House

If the house was worth $70,000 after repairs, I knew I could borrow $42,000 (60%), so all I had to do was buy it cheap enough to make sure the loan would cover all my costs and then some.

In addition to the 18% interest, I was paying Al ten points, that’s 10% of each loan as a broker fee. After I did a few loans, I learned it wasn’t even Al’s money I was borrowing.

wholesale-repair-borrow

My Broker Was Loaning Out Other People’s Money

It wasn’t institutional money. No banks were allowed. It was money from Al’s friends, relatives and business associates. Just plain ole people who wanted to get a high rate of return on their money.

And you gotta admit, 18% certainly qualified. But that’s not all. Every time I paid one of those loans off, I had to pay the lender six months’ extra interest. That’s called a prepayment penalty.

What an ugly price to pay for money, right? I sure thought so, and that’s why I only borrowed from Al 76 times before I quit.

It didn’t take me long to figure out it wasn’t the cost of money that’s important, but the availability of it. Without Al’s money, I couldn’t pay cash for houses and, thereby, get them dirt cheap.

With Al’s money, I could buy fast and get them fixed and sold quickly. You see, every time I paid ole Al 18% and 10 points…

wholesale-each-deal

He got his profit and broker fee, the lender got a high return, and I got easy money. A couple of years later, I started asking for money from people I knew and discovered it was easy to get.

Very quickly, I had more money available than I could use, and I got better terms when I eliminated Al.

I started paying 15% interest, three months prepayment penalty and eliminated the 10% brokerage because Al wasn’t the middle man. Then, a couple years later, I got a mortgage broker’s license and started loaning other people’s money to my real estate investor friends.

Of course, I got paid a fee.

I Was Now Collecting The Same 10% I Used To Pay Al

But this letter is not about being a mortgage broker. It’s about finding all the money you need for your deals, so you can take advantage of the biggest foreclosure bonanza of our lifetime.

It’s also about eliminating Al, so the money you find has no middle man making the rules. You make your own rules.

FYI, today, I borrow money from ordinary people just like I did back then, except the interest rate is 7% and no points are added.

I don’t make monthly payments. That’s right. The interest accrues, so I have no mortgage payments to make. Imagine what that will do to your cash flow while awaiting a buyer for your house or after you install a lease option tenant and start collecting rent with no payments.

Would You Like To Do The Same Thing?

I decided to teach everything I know about private lending to all my students who want to learn. So, I held a 2-day boot camp called …

The Private Lending Boot Camp. I recorded the boot camp and now my Private Lending Home Study Course is available for you

It has one purpose: To help you find all the private lenders you need to fund your own deals.

Here’s A Short List of what You’ll Learn…

How to seek out only the best prospects and prescreen them with one sentence. This does not involve running ads or otherwise wasting money.

Every step to take once they say yes and how to make sure the paperworks gets done properly without your involvement.

How to set the rules and decide what you’ll pay the lenders and make them beg you to take their money.

How to setup an insurance policy to pay off your lenders if you die and leave your properties free and clear for your family.

How to borrow money with no monthly payments to boost your cash flow.

How to get all the money you want to do pretty house deals that require money for down payments or to make up back payments, even when the loan-to-value ratio is high.

How to create an army of lenders who’d love to be your partner in bigger deals when they come along.

How to raise big money with private placements so you can buy cheap foreclosures in big blocks or create a fund to make loans to those who do.

Hey, if you’re gonna make friends, you might as well make friends with people who ain’t broke.

Have You Ever Taught Yourself as A Lender?

Well, now you can be. Just like the banks do. Loan out your money, and get paid well. On the Private Lending Boot Camp Home Study recordings, you’ll learn…

How to get borrowers calling you daily with no advertising costs.

Every single step along with checklists to get the loans closed and protect your interest.

How to reduce defaults and make a bundle if they do occur.

How to get your borrowers to do all the work and pay all the costs, so you don’t have a dime in expenses to close a loan.

How to loan money to your IRA, protect your privacy and do it all tax-free— legally.

How to get a consistent 30% or more annual return, safely and consistently.

Tricks i’ve learned and language to make sure you put in every note to make you more money.

I’ll also share with you all the mistakes I’ve made over the last 24 years as a mortgage broker and save you a lot of grief. Man, these seminars in the School of Hard Knocks are expensive.

IRAs and pension plans are a great source of funds if you know how to tap into them and who to ask. I’ll show you. Actually, there isn’t much you’d want to know about finding and brokering private money that I don’t cover in this course.

You’ll be participating in asking for money, answering objections and closing deals.

The recordings come with a complete systems manual. It’s a masterpiece that has been two years in the making. It’s got everything you need to find money and become a private lender.

Look, if you’re gonna buy and sell houses, these boot camp recordings are an absolute must. Raising money is an important ingredient, especially if you intend to buy junkers.

You can also get through life without eating foods that taste good and running ten miles a day. But why?

The retail cost of these recordings is $1,997, but I’m giving it away for only $997! That’s a $1,000 discount. The fee is minimal, but the long-lasting effects of this boot camp will serve you for life.

To Your $uccess,

Ron LeGrand

Millionaire Maker

1 review for Ron Legrand – Private Lending

Add a review Cancel reply

Related products

Internet Marketing Courses

Ron Legrand – Quick Start Real Estate School (4 Day Event 03/2013)

Real Estate Investing

Ron Legrand – How to get rich in your IRA and never pay taxes

Business & Marketing

Real Estate Investing

Internet Marketing Courses

Real Estate Investing

Sherry Watson - Purpose Into Profits System

Sherry Watson - Purpose Into Profits System

king –

We encourage you to check Content Proof carefully before paying.“Excepted” these contents: “Online coaching, Software, Facebook group, Skype and Email support from Author.”If you have enough money and feel good. We encourage you to buy this product from the original Author to get full other “Excepted” contents from them.Thank you!